Stretchable and Conformable Electronics: Heading Toward Market Reality

Stretchable and Conformable Electronics: Heading Toward Market Reality

Stretchable and Conformable Electronics: Heading Toward Market Reality

Stretchable and conformal electronics are more than just novelties. This article describes how many of the simpler and less glamorous aspects of stretchable and conformable devices have already been commercialized or are very close to being commercialized.

by Khasha Ghaffarzadeh and James Hayward

MOST people still believe that stretchable and conformal electronics (SCEs) are academic curiosities with no particular market. This belief appears to be based on proof-of-concept studies that are occasionally published, based on the results of those rare devices that happen to work well. Even when companies demonstrate prototypes, it is easy to dismiss them as mere marketing exercises devised to make their inventors look like R&D leaders.

However, with regard to the SCE industry, there is much more than meets the eye. At IDTechEx (the market research firm at which we are based), we have been researching this technological frontier for several years. In this article, we will describe how many of the simpler and less glamorous aspects of SCE have already been commercialized or are on the cusp of being commercialized. And we will discuss two major trends underpinning interest in SCE: (1) wearables going truly wearable and (2) structural electronics. Furthermore, we will argue that viewing SCE as a single entity is grossly misleading. SCE is an umbrella term under which exist many different technologies and applications. It is appropriate to view SCE as a collection of disparate niche applications and solutions.

Wearable Technology Is Becoming Truly Wearable

Interest in wearable technology rose exponentially starting in late 2013. This was accompanied by the emergence of several new product categories that helped define the new wearable tech vs. the old wearable tech (pocket and wrist watches, dating back centuries). These new categories included smart connected watches, smart eyewear, virtual- and augmented-reality glasses, and more.

Each of these categories is very different in terms of underlying technology, readiness level, target markets, and current and future earning potential. In fact, in a recent market forecast, our team tracked 42 separate categories of wearable devices, with an overall growth from a current base of around $US35 billion to more than $US155 billion by 2027.

There is often little unifying these disparate technologies. Indeed, there is a real possibility that the divergent fortunes of these categories will render the umbrella term of wearable technology irrelevant in the not-so-distant future.

Despite this pending divergence, a common trend across nearly all devices is a change in form factor. If you scan the current landscape of products you will soon find that they are simply old, rigid components assembled into a new “box” that can be worn somewhere on the body. Nearly all these components are borrowed from existing industries such as the consumer electronics, medical, or automotive sectors. There exists relatively little hardware innovation for creating truly wearable devices.

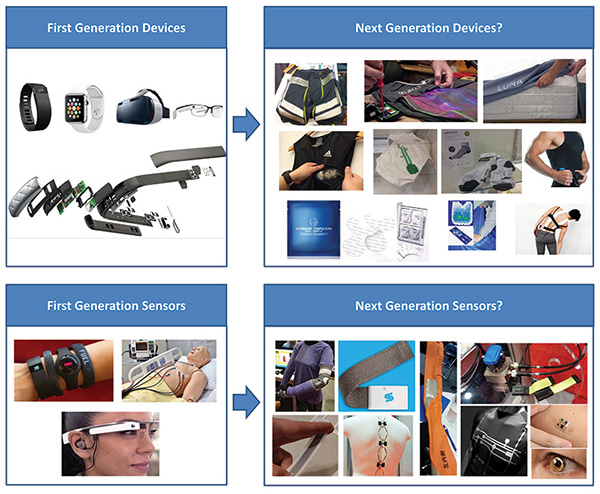

This is changing. As shown in Fig. 1, companies large and small are beginning to make wearable devices truly wearable. Often, these are early-stage exploratory products that have been developed to test the waters and are not yet mature, tried-and-tested, finished articles.

Fig. 1: Wearable devices are beginning to transition from rigid components in boxes toward truly wearable devices. So far, nearly this entire market is served by existing sensors borrowed from other industries. However, we now see the rise of new sensors made with wearability in mind. Image sources: Fitbit, Apple, Samsung/Oculus and Google, and IDTechEx photos of Clothing+/Myontec, Bainisha, Toyobo, Parker Hannifin, EMS/Nagase and others.

Stretchable Electronics for Wearable Technology

Work toward creating truly wearable devices includes all required parts of the system. There is progress in stretchable and/or conformable batteries, transistors/memories, displays, sensors, PCBs, and interconnects (stretchable connections). Most SCE components are, however, still at a very early stage of technological readiness. Here, therefore, we focus on stretchable interconnects and sensors as two examples of SCEs that are already commercial or on the edge of being commercialized.

Interconnects may seem like simple elements, but they are crucial in enabling truly wearable textile-based applications. Currently, there are several approaches for creating textile-based interconnects, including fine metal wire and metal-coated fiber/yarn. Stretchable conductive inks are also emerging as a serious contender to fulfill this role. This is because conductive ink technology is highly adaptive, enabling custom products to be developed to satisfy different price and performance (conductivity, stretchability, etc.) requirements. This is critical at this exploratory stage of the market when the customer requirements are not fully known and can be very divergent.

Inks have a further advantage in that they are a post-production step that can be universally applied once a textile is made using existing unmodified processes. Indeed, ink technology has the potential to piggyback onto existing infrastructure and know-how for screen printing graphics on textiles.

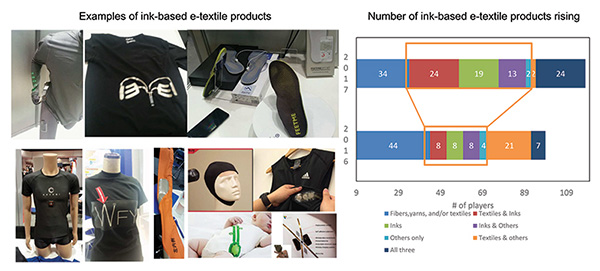

As shown in Fig. 2, there are already many electronic textile (e-textile) prototypes and products that use flexible and/or stretchable conductive inks. These examples range from heart-rate monitors for humans and animals (e.g., horses), shoe in-sole pressure sensors, interconnects, and so on. In general, our statistics, shown in Fig. 2, demonstrate that interest in stretchable inks is on the rise. The number of ink-based e-textile products/projects is significantly up year-on-year.

Fig. 2: At left are ink-based e-textile prototypes and products. Image sources: Holst Centre/DuPont (Wearable Expo Japan 2017), FEETME/DuPont (Wearable Expo Japan), Bebop impact sensors, Mimo breathing sensor, stretch sensor by Bainisha, activity sensors by Clothing +, Toyobo (Japan 2017), Jujo Chemical (FineTech 2016), Maxim Integrated, Toyobo (Japan 2017). (The information in parentheses indicates where/when IDTechEx analysts took the photos.) At right are statistics showing that the popularity of ink-based solutions is on the rise in e-textiles. Source: IDTechEx.

Despite this interest, stretchable inks are not yet a finished commodity-like article. There is much room for continued improvement and customization. In the current approach, the printed layer is sandwiched between a plastic substrate and an encapsulation layer, and is then laminated onto the textile. This is not a sufficiently elegant solution in that

it requires two additional layers. The substrate is used essentially to create a common surface in an industry in which numerous textiles exist, each offering a widely different surface characteristic. The commonplace encapsulation materials are also not yet perfect in that they are not very breathable or even comfortable. The performance of stretchable inks can also be further improved, even though the latest generation is better at suppressing resistivity changes with elongation and at withstanding washing conditions, compared to earlier versions. All this suggests that there is opportunity for material innovations and improved formulations to enable more stretchable inks that can be applied directly onto various textiles with strong adhesion.

This trend has so far been characterized by a push from material/ink suppliers, and not every company is experiencing commercial success. In fact, we are still in early days and the value chain for e-textile is still being shaped, with active involvement from traditional textile makers, large contract manufacturers, and major brand owners.

Many examples of SCE sensors are either commercialized or close to commercialization. For example, piezoresistive sensors are already commercially used to measure pressure distribution over uneven topographies. One use case involves measuring the topography of a patient’s teeth. The patient bites on the piezoresistive sensor, and by doing so, changes the sensor’s thickness, and thus its resistivity, at various locations, allowing for a reading. In such applications, the degree of stretching is often low, whereas surface conformity is excellent and essential.

Many other types of stretchable sensors are also being developed. One example involves stretchable strain sensors that measure large (>100 percent) displacements, well beyond the capabilities of standard strain gauges. The device architecture can be relatively simple; for example, a dielectric-polymer can be sandwiched between two printed electrodes to create a capacitive strain sensor. These sensors are being aggressively commercialized by several suppliers around the world. The target application space is potentially very broad, spanning e-textiles, robotics, industrial machinery, and so on.

Although it may seem that there is a sudden commercial interest in and progress on SCE, these technologies are not overnight wonders. For example, consider the simple dielectric-based stretchable strain sensors. Working examples have been developed, but companies have been trying to commercialize these for more than 13 years. During this time, the IP and commercialization rights for this technology have changed hands at least three times, and numerous potential markets have been tested, creating a large accumulation of commercial experience.

Structural Electronics Are a Potential Endgame for Electronic Devices

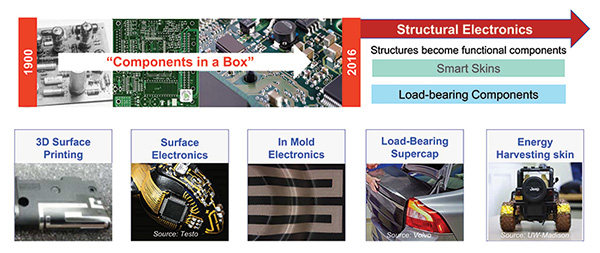

Structural electronics represent a megatrend that will transform traditional electronics from being components-in-a-box into truly invisible electronics that form part of the structure itself. This is a major, long-term innovation that will lead to a root-and-branch change of the electronic industry, including its value chain, materials, and components (Fig. 3). Stretchable and conformable electronics are giving shape to this megatrend. Indeed, they enable it.

Fig. 3: Structural electronics represent a trend that will see electronic functionality become a part of the structure itself.

In one manifestation of SCE in structural electronics, electrodes/antennas are deposited on the surface of 3D-shaped objects, eliminating the need for a separate printed circuit board. Here, as in piezoresistive sensors, stretchability is important in the form of ready 3D surface conformity rather than elasticity or high-strain capabilities. In another manifestation, in-mold electronics (IME) is helping to structurally embed electronic functionality into 3D objects made using high-throughput processes such as thermoforming.

In IME, electronic materials, together with graphics inks, are deposited (printed or coated) onto a flat sheet before being thermoformed into a 3D shape. This causes the materials to experience a one-off major stretching event. If standard materials are employed, this stretching will cause layer cracking and failure. The materials used therefore need to be specially made or formulated to become IME compatible.

Herein lies an opportunity for material suppliers. The first material to respond to this need has been conductive ink, partly because of its technological adaptability in terms of custom formulations. This flexibility has helped it become IME compatible. Indeed, as in the development of commercial stretchable conductive inks, IME-compatible material experiences a one-off stretching event. There were only two or three suppliers two years ago or so, but now many ink suppliers have demonstrated capability or commercially launched their products, often with aggressive pricing strategies.

The materials menu is of course not limited to conductive inks. Another major component that is becoming IME compatible is transparent conductive films (TCFs), which form the basis of capacitive touch-sensing technology. These stretchable TCF technologies, including those based on carbon nanotubes (or nanobuds), silver nanowires, and PEDOT, can enable 3D-shaped touch surfaces made using molding processes.

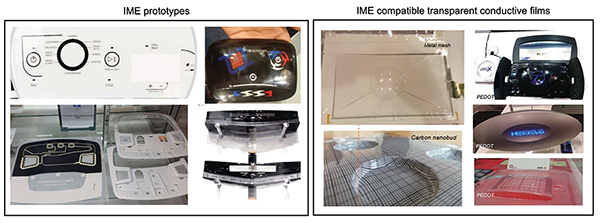

As shown in Fig. 4, there are already numerous IME prototypes aimed at high-volume white-good

(home) appliances and automotive applications. Many such prototypes are in late-stage qualification. Interestingly, IME had previously had a false start in that an IME overhead console had been adopted into a car before malfunction (attributed to process simplification going from prototyping to mass production) caused the product to be recalled. This cautionary tale further underscores the fact that SCE did not appear overnight and has in fact been in the making for years. Note that despite that recall, commitment has remained strong behind the scenes and we expect commercial product launches soon.

Fig. 4: There are many examples of IME prototypes that are aimed at white-good appliance applications, such as washing machine human-machine interfaces, as well as at automotive applications, such as overhead or heating control consoles. Sources: In box at left, clockwise from top left: Jabil, Tactotek (Printed Electronics Europe 2016), DuPont (Wearable Expo Japan 2017), DuPont (IDTechEx Show! 2016), Jujo Chemical (FineTech Japan 2017). In box at right are examples of various

thermoformed transparent conductive films. Sources: clockwise from top left: Fujifilm (IDTechEx Show! USA 2016), Negase (Nepcon Japan 2017), Heraeus (IDTechEx Show! USA 2016), Aga (FineTech 2014), Canatu. (Information in brackets indicates where/when IDTechEx analysts took the photo.)

A Slow and Profitable Path to Innovation

There will be much more innovation in SCE in years to come, because all electronic components, to various degrees, are becoming stretchable and conformable. As described above, most are still years away from commercialization. This is partly due to technological immaturity but also because SCE components are often very different from their rigid counterparts in terms of performance and application. Consequently, they cannot just be considered a substitute for the next generation of existing components/materials.

Indeed, SCE components must find and create new markets and new product categories. This requires extensive time-consuming exploration of many niche markets. We currently see that several SCE components are exactly in this phase: the market is experiencing many divergent application ideas. This phase will inevitably end as hit products are found, causing the industry to consolidate around them. This period of convergence will then continue until competition erodes margins, forcing players to seek new markets and unleash the next phase of divergence.

The high level of diversity, however, both in terms of technologies and target applications, will ultimately offer resilience to the SCE market. While every application won’t succeed, it would be unreasonable to assume that every application will fail. In our forecasts, we can see a $US600 million market by 2027 for SCE. For further details please refer to our report, Stretchable and Conformal Electronics 2017–2027, available at www.idtechex.com/stretchable. •

Khasha Ghaffarzadeh and James Hayward are analysts for IDTechEx, a market research and technology consulting firm with headquarters in the UK. They can be reached at khasha@idtechex.com and j.hayward@idtechex.com, respectively.