Shipments of AMOLED TV Panels Will Be Limited for the Next Few Years

Compared to LCDs, AMOLED TV panels will represent a small part of the total panel market in the years ahead, even as AMOLED TV panel production increases.

by Vinita Jakhanwal

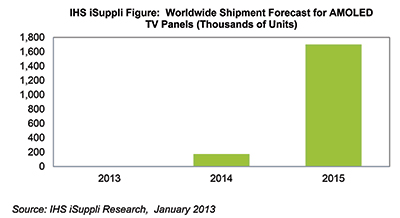

ACTIVE-MATRIX organic light-emitting-diode (AMOLED) televisions have been appearing at consumer-electronics shows and are just entering the marketplace, but shipments of AMOLED TV panels will remain limited during the next few years, according to the Emerging Display Service at information and analytics provider IHS. AMOLED TV panel shipments are expected to climb to 1.7 million units in 2015, up from just 1600 units in 2013, as shown in Fig. 1.

Fig. 1: AMOLED TV panel production will increase at an impressive rate between 2013 and 2015. Source: IHS.

While the jump in shipments appears phenomenally large, the total number of AMOLED panels by 2015 remains negligible compared to the vast number of liquid-crystal display (LCD) panels being shipped. As a result, AMOLED TV panel production, even as it increases, will make up a mere fraction of the total LCD panel market – expected to reach 266.3 million units in 2015 – in the years ahead.

The viewing public caught an eyeful of AMOLED TVs when they were featured prominently at the Consumer Electronics Shows in Las Vegas the last 2 years, with prototype models exhibited by leading manufacturers such as Samsung, LG, Panasonic, and Sony generating major excitement. As its name implies, AMOLEDs use organic materials that play a significant role when transforming electrical energy into light energy. AMOLEDs do not need additional backlighting, leading to displays with high contrast ratios, fast response times, thinner profiles, and the potential for better power efficiencies.

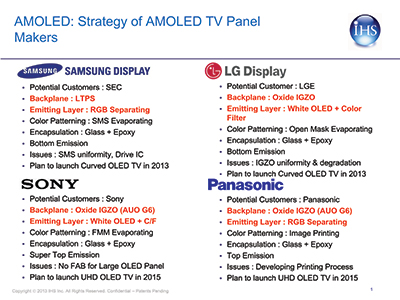

Korean manufacturers LG Display and Samsung Display are spearheading investments in research and development as well as manufacturing capacity to take AMOLED TVs from early technology demonstrations to market reality. However, limited availability – as well as the high retail pricing – of AMOLED TVs will likely restrict their shipments during the next few years. This article looks at how the different AMOLED panel makers – Samsung Display and LG Display, as well as Sony, Panasonic, and some other newer players – have approached the market and what their plans for the future may be (Fig. 2).

Fig. 2: AMOLED TV panel marketing strategies of the major manufacturers are compared above. (SEC = Samsung Electronics and LGE = LG Electronics.)

Samsung Display

AMOLED displays entered the commercial marketplace on a significant scale in 2007, when Samsung began mass-producing panels for smartphones and media players. Since then, Samsung Display has led the industry in capital investments and technology developments, with much-needed support coming from the Samsung Electronics handset design and development team.

In Q2 2011, Samsung started production of mobile handset displays at the AMOLED industry’s first Gen 5.5 fab. The subsequent output helped the overall AMOLED market to reach the shipment volumes needed to support the large numbers required for the growing phone market. The increased panel shipments, the larger panel sizes (for smartphones), and technological advances such as on-cell touch that helped raise unit prices per panel, all contributed to more than doubling the total market value of AMOLED. At the end of 2012, AMOLED panels accounted for around 10% of the smartphone display market. With success in the smartphone market and associated achievements in improving yields and manufacturing costs, Samsung started focusing its efforts toward creating AMOLED panels in sizes suitable for TVs.

To create its AMOLED TV prototypes, Samsung used low-temperature poly-silicon (LTPS) TFT backplanes, RGB OLEDs, and the evaporation method, similar to what the company had successfully been using in its smartphone displays. TV sets made with LTPS TFT backplanes and RGB OLED evaporation technology exhibit improved OLED performance, achieving much wider color gamuts and extremely high contrast ratios, it is generally agreed. But with low yields and high costs, Samsung may find it difficult to launch AMOLED TVs on a large scale in 2013 using these technologies. Samsung recently announced that it may be considering a white OLED with color-filter approach as well to help commercialize AMOLED TVs faster. For more about OLED TV manufacturing techniques, see the article “RGB Color Patterning for AMOLED TVs” in the March/April issue of Information Display.

In terms of manufacturing preparation, Samsung’s Gen 8.5 plan for TV mass production calls for two 8.5G lines to be set up in the second and third quarters of 2013, to be used for R&D purposes until the end of the year. The equipment will then be put into use for mass production in 2014, when Samsung begins making TV panels in earnest. Each equipment line will be capable of producing approximately 9000 panels per month.

LG Display

LG Display, which acquired Kodak’s AMOLED patent portfolio in 2009, has also been supporting the AMOLED mobile handset market, using its Gen 4.5 fab mainly to manufacture displays for Nokia handsets. LG has been focusing on a white-OLED with color-filter TV panel process using both phosphorescent and fluorescent materials that could help ease the mass production of AMOLED TV panels as compared to the RGB approach. The process also uses oxide-TFT backplanes and an evaporation method, eliminating the need for fine-metal-mask technology in OLED production.

LG Display is currently speeding up its TV panel development and nearing completion of preparation for mass production, with partial production having begun in early 2013. The company is also focusing on making panels through a Gen 8.5 fab. LG Display recently announced a $650 million investment for a new Gen 8 line likely to start production in January 2014. Approximately 7000 panels per month are expected to be produced by LG starting in the second quarter. The company hopes to produce 75,000 AMOLED TV units annually.

Both Samsung and LG also unveiled their own curved 55-in. AMOLED TV prototypes at CES, with sets boasting a 4-m radius of curvature and full-HD resolution. The success of Samsung and LG in implementing a large-sized curved OLED was thought to be a meaningful achievement in the display industry. However, both companies still face challenges with mass production and market availability of curved OLED TVs is not a near-term possibility.

Sony and Panasonic

Also showing AMOLED TVs alongside Samsung and LG this year at CES were Panasonic and Sony, which both unveiled 56-in. 4K (ultra-high definition or UHD) AMOLED TV prototypes. The sets boasted four times– hence 4K – the resolution of current 1080p televisions. For the 4K AMOLED samples, both manufacturers used oxide-TFT backplanes, which should incur lower manufacturing costs than LTPS backplanes at some future time, when processes are perfected.

Back in 2007, Sony launched an 11-in. AMOLED TV based on RGB emitters at CES and then continued to produce this TV in small volumes for 5 years before discontinuing it by 2012 because of high manufacturing costs and low yields. To make the TV it showed at CES this year, Sony used evaporation technology to deposit organic material in its top-emitting white-OLED structure with a color filter. Sony’s panel was provided by AUO of Taiwan in joint development efforts between the Japanese and Taiwanese partners. Sony’s (top) emission technology optimizes the OLED structure, which helps achieve better light management, enhances color purity, and attains higher contrast at lower power-consumption levels. For its 56-in. 4K AMOLED TV at CES, Panasonic used the so-called “printing” method, a technology designed to make OLED production adaptable for a wider range of display sizes. (The details of Panasonic’s “printing” method remain undisclosed at the moment.) At CES, AUO also introduced its own 32-in. AMOLED TV using an oxide-TFT backplane with a white-OLED structure.

Using different technological approaches, Sony and Panasonic were both able to make UHD 56-in. displays that reached 79 pixels per inch (ppi) –twice the density of the 55-in. FHD displays used in the OLED TVs from LG and Samsung. The latters’ TVs are closer to mass production, however. LG and Samsung had positioned themselves to release large-sized AMOLED TVs at an earlier date than Sony or Panasonic. In Japan, Panasonic and Sony have started joint work to study how to make large-sized AMOLED panels on a commercial basis by using Panasonic’s Himeji fab, but it is not certain if investing capital is being considered for

a production line. Sony is currently producing 17- and 25-in. AMOLED monitor panels for the broadcasting industry.

Other Market Players

While the South Koreans appear to have a head start in AMOLED panel production, panel makers in China, Taiwan, and Japan are also hoping to enter the market. In China, backed by government support, most Chinese panel makers are looking at starting their own AMOLED business. Nonetheless, given the twin challenges of high costs and low yields associated with commercializing backplane and deposition processes, large-scale AMOLED production from China is unlikely anytime soon. Many Chinese panel makers – including CSOT from Shenzhen, Visionox from Kunshan, Tianma from Shanghai, BOE in Herfei, and CCO from Chengdu – all have announced investments and plans for AMOLED production, but none has materialized with immediate production.

For their part, panel makers from Taiwan are trying to achieve commercial success with as little investment as possible, as financially they cannot afford on their own to bring in new production equipment for AMOLED, LTPS, and oxide TFTs. AUO, which has facilities in Singapore and Linkou that are focused on producing small- and medium-sized AMOLED panels, failed to keep up with its plan to produce 4.3-in. AMOLED panels in the second quarter of 2012 – and then rescheduled production for the first half of this year. AUO’s Lungtan facility will likely be used for producing AMOLED TV panels, however, with technological support from Sony in developing oxide-TFT backplanes to produce 32-in. OLED TVs beginning the second half of this year.

Yield Improvement and Cost Reduction Remain Barriers

While OLED TV makers all hope to become the acknowledged leaders in their space, more improvements in technology, materials, and manufacturing appear to be needed in order to bring large numbers of AMOLED TVs to the market. And, in addition to technical and large-volume manufacturing challenges, OLED TVs also face an uphill task of competing on prices with lower-priced, low-power, higher-resolution 4K LCDs and even FHD LCD TVs. By the time AMOLED TV production achieves efficiencies in large-scale production, LCD TVs will have had an opportunity to become even more competitive in price and performance. Despite the appearance of many promising AMOLED TV prototypes at CES, the number of challenges that still need to be addressed mean that most consumers are likely to wait a few more years before they buy their AMOLED TVs. •

Vinita Jakhanwal is Director of Mobile & Emerging Displays and Technology for IHS. For media inquiries on this article, please contact Jonathan Cassell, Senior Manager, editorial, at jonathan.cassell@ihs.com. For non-media inquiries, please contact analyst.inquiry@isuppli.com. Learn more about this topic with the IHS iSuppli Display Materials & Systems service. For more information, please visit http://goo.gl/72n4S.