Alpha and Omega: Most Exciting Display Technologies at CES

Giant TVs, ultra-high definition, IGZO, and more were among the display showstoppers at this year’s Consumer Electronics Show in Las Vegas.

by Steve Sechrist

ONE of the best things about being part of SID is the opportunity to see the “alpha and omega” of the display industry. This includes products or technologies that start in the lab or are just the germ of an idea to product concepts and then to shipping displays. Pixel-dense UHD TVs, anti-reflective materials, and almost any display technology that is breaking news today was first dreamed of, then dis-cussed, then prodded and poked at during SID’s Display Week; sometimes years before making it to the CES show floor in January. Let’s take a look at the “omega” side of displays and some key trends uncovered at this year’s CES.

UHD Thunder: China Struts Its Stuff

The unmistakable display technology of note at CES was ultra-high definition (UHD). Just as 3-D was all the rage 2 years ago, most vendors this year had UHD offerings, includ-ing all tier-one companies, the Taiwanese LCD makers, and almost every Chinese mainland brand. Remarkably, it was the 84-in. UHD TV that seemed to be near-mandatory in Las Vegas, with almost every brand showing multiple TVs boasting a large-screen 4K × 2K set.

Among the China-based notables showing 84-in. UHD sets were TCL (also with a 110-in. model) Skyworth (see Fig. 1), Westinghouse, Haier, and Hisense with five models, making that China-based company the one with the most 4K sets. The Hisense units ranged from 50 in. to an eye-popping 110 in. on the diagonal with a pixel resolution of 3840 × 2160 (see below). The products looked very close to commercial status – they were not just prototypes. To get a look at the competition tier-one brands are facing from Chinese companies, see the specifications for Hisense’s flagship XT900 4K models, which it calls U-LED TVs.

Fig. 1: This 4K China Skyworth UHD TV is sourced from CMI Display Taiwan. Photo courtesy Steve Sechrist.

Hisense XT900 U-LED 4K TV Specifications

• UHD (3840 × 2160) native resolution, 120 Hz

• WiFi enabled

• Smart TV with Google TV

• 65-, 84-, and 110-in. screen sizes

• 3-D

• Smart-TV functionality

• Precise local dimming

• “Mega” dynamic contrast ratio (the backlight can be completely turned off in local regions to greatly extend the dynamic range)

• Multi-screen play

• Detachable camera (Skype calling, gesture, and facial recognition)

• Voice-control remote that allows voice activation for on-off and channel changing.

As far as LCD fab sources for the giant 110-in.-diagonal panels is concerned, I was told in the TCL booth by product manager Jain Peng “Konan” Jiao that the fab used by TCL was a result of its Joint Venture Gen 8.5 with Samsung, called China Star Optoelectronics Tech (CSOT). Other panel makers with a 4K offering at CES included Sharp (using its IGZO technology), Samsung, LG, Sony, Panasonic, and Toshiba.

4K Monitors at CES will Probably Ship First

It’s interesting to note that the Panasonic UHD-class 20-in. hybrid tablet/display with a 15:9 aspect ratio could be used as a tablet or desktop monitor. The device includes an IPS 4K × 2K panel and was shown at CES running Windows 8 with an Intel i5 Core (1.8 GHz) and up to 16 GB of memory.

With this technology, Panasonic seems to be looking to extend desktop monitors into a new class of device that can also serve double duty as a tablet (albeit in this case, a mighty big one.) The company said it is targeting professionals who need very high resolution (photographers, engineers, and architects.) Perhaps another way to look at the product is as a portable “all-in-one” desktop PC with the advantage that it can be taken into the field.

LG, Sharp, and ViewSonic all showed examples of smaller 4K displays with 30-in. panels, and while the LG 30-in. unit was a prototype (found nested in a window

wall in the booth), specs include 153 ppi, 500 nits, and 99% of the RGB color gamut. This panel is probably aimed at OEM customers.

Meanwhile, Sharp claimed the “world’s thinnest” 4K monitor with its 32-in. diagonal model, which is less than 1.5 in. thick and is based on its new zinc-oxide-TFT technology. This panel also sports a 10-point discrete touch screen, as IGZO allows for more discrete sensors. According to Sharp, IGZO can cycle the power-down state of the panel at a very high rate, enabling a far “quieter” electromagnetic environment. This allows the use of much higher sensitivity devices that cannot work with conventional AMLCD panels (see the IGZO write-up below.)

This Sharp monitor was announced in November 2012 prior to CES. It has a pixel density of 137 ppi and will retail at around $5000. ViewSonic showed its 32-in. 4K monitor at CES and said the product will launch “sometime in 2013” with pricing to be announced.

4K Empowers 3-D

In the booth of Hisense, based in Qingdao, China, the company was using a 60-in. UHD to show off its autostereoscopic 3-D technology. Hisense went so far as to give the product a model number (GF60XT980), while at the same time calling it a “proof-of-concept model,” with no price or ship date. “By using a Hisense ultra-high-definition 2160p panel, even at half the normal screen resolution, viewers can still enjoy a truly high-definition picture,” according to Peter Erdman, Hisense Group VP.

In terms of the images used at the show, the company did a very good job of simulating depth with its autostereoscopic prototype. It’s important to note it was not displaying commercial 3-D film content, but rather multi 3-D layering content that demonstrated the technology in a subtler way. On-axis viewing was discernably better than viewing from the sides. Hisense did say it was using a face-tracking technology to adjust the 3-D sweet spot, and this may have been “overloaded” with the large crowds viewing the screen at the show.

Hisense also showed a transparent 3-D display for digital-signage applications (Fig. 2). The company used an LCD frontplane with passive 3-D capabilities and a mounted backlight with a 1-m (or so) gap in between where merchandise can be placed. The objective was to demonstrate how to use the LCD with current 3-D virtual content over any real merchandise in the background. In a storefront configuration, a window with merchandise behind it can be displayed. Hisense sees applications in real-estate demos, window advertisements, showcases, and around the home.

Fig. 2: Hisense showed transparent 3-D technology for digital-signage applications at CES. Photo courtesy Steve Sechrist.

Most UHD TVs shown at CES were 3-D capable. Some of the vendors were using UHD to create an autostereo TV image. These included Dimenco, showing an 11.6-in. switchable prototype using the company’s “Nabla” lenticular lens and new liquid-crystal cell design with low-voltage switching. Dimension Technologies, Inc. (DTI) also had an autostereoscopic technology on hand, with an 8-view, glasses-free display using a unique time-multiplex backlight system. Dolby showed a new autostereo panel they developed with Taiwan-based CMI by using a Philips lenticular lens along with stereo image processing by Dolby, converted to multi-view and streamed over a Vudu encoding format. Stream TV showed a set (UHD 60 in. at 2160p) with a non-lenticular 3-D stack combining diffractive and refractive optics to guide light in the right direction within an established viewing distance.

On the standard (glasses-based) 3-D side, most major players (Sony, LG, Samsung, etc.) continued to show their active and passive 3-D technology, including Vizio, which demonstrated passive technology in two sets: 65- and 70-in. models in its XVT (UHD TV) Smart-TV series.

Content is Still King, But Where Is It?

What was interesting at CES was that 4K glass (UHD TVs) seemed more prevalent than the content needed for viewers to take advantage of the high-pixel-density

displays. It is the familiar Catch-22 cycle: there is no content, so no one buys the displays, so no one makes the content since no one is waiting to view it.

One way HDTV overcame this content hurdle was through the DTV transition and through over-the-air broadcasts of HD content. In that vein, LG did show a 2012 joint pilot venture with KBS (Korean Broadcasting System) that used 4K over the air. The antenna technology used for this venture was on display in LG’s booth.

This, along with full-HD up-scaling and of course producing (or re-mastering) original film content to air on giant, high-pixel-density screens will eventually fill the 4K content pipe and help drive demand as we move from full-HD into new UHD-display frontiers. It’s hard to imagine the 500 lines of last century’s SDTV lasting for more than 50 years in light of the DTV transition, full-HD broadcasts, and even the (albeit limited) 3-D sports and event broadcasts of today. (For more about the timeline for UHD broadcasts, see NHK’s article, “Super Hi-Vision as Next-Generation Television and Its Video Parameters” in the November/December 2012 issue of ID.)

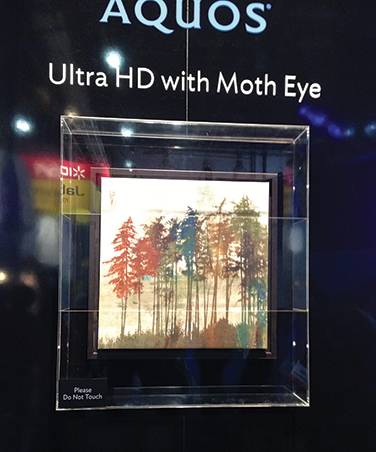

Biomimicry: Sharp’s Moth-Eye Technology

An example of the aforementioned alpha–omega technology progression from SID to CES is the Moth-Eye nanotechnology described at SID 2011 in a presentation showing how it enabled a dramatic reduction in glare. At this year’s CES, prominent in the Sharp booth was none other than a Moth-Eye demonstration of how this “biomimicry” anti-glare technology will be used by Sharp to remove glare from indoor screens, with an aim toward tuning it for outdoor purposes in the long term (Fig. 3).

Fig. 3: Sharp Moth-Eye display shows technology introduced at SID in 2011. Photo courtesy Steve Sechrist.

Moth Eye creates nanohexagonal patterns of bumps on a film surface (spaced 300 nm apart) that are smaller (200 nm) than the wavelength of visible light, creating a continuous refractive-index gradient (removing the air–lens interface.) Moth Eye gets its name from nature, which uses this strategy in common night-flying moths to prevent light reflection and thus help the moths conceal themselves from predators. Early reports of the technology go back as far as 2003, with development

credited to MacDermid Autotype (Autoflex film) and Fraunhofer Institute for Solar Energy in Germany.

Truth be told, commercial Moth Eye was first revealed by Sharp at CEATEC in Japan last October, when the company announced its Aquos Quattron (3D XL vintage) with sizes ranging from 46 to 80 in., all due to feature the new technology in 2013 product roll-outs.

The Move to Giant TVs

At the pre-show press conference, Sharp (and others) indicated the company will continue its large-and-larger display strategy, selling displays that top out at 90-in. on the diagonal. At the press conference, Sharp said it will migrate to the 90-in. sets from the current 80-in. ones based, in part, on U.S. consumer numbers that show the plus 60-in. category is the fastest growing size in the TV space. In 2011, 60-in. sets were just 4% of the LCD-TV market in terms of revenue, according to Sharp. That number has grown to 20% of LCD-TV revenue. The company plans to offer 21 models that are 60 in. and up, at prices as high as $10,000. Look for more big sets from all major LCD players as they transition to UHD sets in the middle of this year.

China’s Full-HD Mobile Displays

Even with the Mobile World Congress event taking place just weeks after CES, the China smartphone brands all used CES to launch full-HD handheld displays that are sure to dominate the wireless smartphone and tablet space in 2013. Tier-one brands such as Samsung and LG only hinted at these new higher-pixel-density models. Case in point was Huawei, which announced a 5-in. 1080p display with an impressive 443-ppi pixel density in its new flagship Ascend D2 Dream Phone. The Grand S (flagship model) from ZTE is a 440-ppi 5-in. 1080p display. Other China-based brands to offer a full-HD handheld included the Vizio Via (5-in. full-HD screen), the Alcatel Scribe X (with a 1080p 5-in. display), and the Lenovo K900 with a 5.5-in. 1080p IPS display that uses an LG AMLCD panel.

Sony’s new flagship Xperia Z smartphone (Fig. 4) attracted lots of attention on press day at CES. The phone features a 5-in. 1080p display and a remarkable water-resistant design. Meanwhile, Sharp announced its continuous-grain-silicon (CGS) 5.1-in. smartphone for the Japanese wireless market that boasts 443 ppi. Sharp said its CGS LCD panel is also available for the OEM market. It first showed the technology in October at CEATEC, where its IGZO technology took the Top Innovation Award in electronic components.

Fig. 4: Sony’s Xperia Z, a water-resistant 5-in. full-HD smartphone, stole the show in the mobile space. Photo courtesy Steve Sechrist.

The CGS backplane is based on crystalline silicon, with an electron mobility up to 600 times faster than that of ordinary amorphous silicon and up to 6 times faster than that of low-temperature polysilicon (LTPS), the current technology in the iPhone retina class iPhone 4, according to Sharp. The panel is being made at Sharp’s Mei Plant No. 3, using technology jointly developed along with Semiconductor Energy Labs (SEL) in 1998. SEL is the same company that helped Sharp with IGZO. Sharp said its new full-HD 5-in. set also achieves a brightness of 500 cm/m2.

OLEDs Almost Eclipsed by UHD

Sony and Panasonic, along with LG and Samsung, all had an OLED TV story to tell at CES and most (except for LG) were still singing the old “sun will come out tomorrow” song with beautiful images and no specific launch date. Meanwhile, LG did take the plunge, announcing just prior to CES that it had begun taking pre-orders for its 55-in. (55EM9700) TV. A February 2013 delivery was scheduled for the new OLED 55-in. ultra-slim sets in Korea (for about $10,000 a piece). They are due to ship to the U.S. in the March 2013 time frame – finally, some progress.

LG will be using its white OLED (WOLED) and color-filter approach to get to market with what some call a simpler approach to solving some OLED materials lifetime issues. This approach is based on solutions the company developed, in part, by using Kodak patents. Meanwhile, Samsung is using the tried-and-true RGB color OLED approach that brought the company OLED display dominance in the small-to-medium display space. To date, no one sells more AMOLED panels than Samsung. (For more about the two different approaches, see the article “RGB Color Patterning for AMOLED TVs” in this issue.)

Japan-based Sony and Panasonic were both present at CES with new 56-in. OLED panels, therefore claiming the “world’s largest” title from Korean manufacturers. But at this late state in the OLED-TV game, one may rightly ask whether without a model number or ship date, does this have any real meaning?

E Ink Displays at CES

E Ink was a Best of CES display winner with an interesting prototype from a Russian-based company, Yota Devices. This was a two-sided Android device, the “Yotaphone,” with a 4.3-in. 720p HD LCD on one side and a power-saving E Ink monochrome display on the other. This configuration allows the device to act as a regular smartphone, but also an e-Book reader and platform for applications not requiring the more memory-hungry color LCD. The company also had flexible displays at an evening post-show event; one prototype was Central Standard Timing’s “CST-01” bendable watch display that’s worn on the wrist. While multiple E Ink tablets were present at CES, we were told by Marketing VP Sriram Peruvemba to look for the technol-ogy to begin moving more rapidly in the digital-signage space, as bi-stable, low-power, and ultra-thin displays empower a growing class of signage that includes retail shelf labels, hybrid static/dynamic posters, and rugged outdoor displays.

IGZO and New Life for LCDs

Finally, this report would not be complete without mention of the ground-breaking IGZO technology shown at CES by Sharp. In an extended meeting with Sharp engineers, I learned that the technology transforms displays using its indium gallium zinc oxide with “far superior” electron mobility and much smaller thin-film transistors (TFTs) to boost the pixel aperture ratio (or the amount of light that can go through an R, G, or B subpixel).

This development is creating a ripple effect throughout LCD fab design and should enable not just lower power from fewer backlights, but the ability to modulate the panel power (with cycles down to 1 Hz) depending on content – something Sharp calls “variable refresh.” This, plus an off-state panel, will create a virtually electromagnetic (EM) noise-free sensor environment allowing the panel to integrate not just discrete multi-touch sensors, but an entire array of new sensor technology (think bio/cellular, as well as UV sensors, atmospheric, olfactory, you name it ...). In addition to sensor-integration enablement, IGZO allows for deep pixel integration shown in some Sharp models of up to 1000 points per inch.

Suffice it to say, the best and brightest were on display at CES, with China beginning to show major strides not only in keeping pace, but in leading the display industry in key technology fields. As 2013 dawns, we are beginning to see the rise of Chinese display technology dominance and perhaps the reassertion of the tried and true LCD (via UHD and IGZO) that are sure to be major factors in the display industry going forward. •

Steve Sechrist is a display-industry analyst and contributing editor to Information Display magazine. He can be reached at sechrist@ucla.edu or by cell at 503/704-2578.