The Display Industry: Fast to Grow, Slow to Change

The development of the display industry over the past 50 years shows the long development cycles of display technologies, the importance of key applications that supported manufacturing investments, and the role of such investments in determining the location of production. The industry has grown rapidly, but fundamental changes in technology, applications, and production have taken place over many years.

by Paul Semenza

FOR MOST of the Society for Information Display's 50-year history, the display market has been dominated by the cathode-ray tube (CRT), which has been in production for nearly a century. The development cycle of the flat-panel displays that took over at the turn of the 21st century can be measured in decades, with different technologies coming together over time, and significant investments required to move those technologies from demonstration to mass production.

Throughout the 1960s, work at several research laboratories was conducted on various types of passively addressed liquid-crystal displays (LCDs), building on the fundamental discovery of the twisted-nematic liquid-crystal (TN-LC) mode dating back to as early as 1911. These efforts converged to produce the first demonstration of an active-matrix display reported in 1971. In 1983, Seiko-Epson became the first company to manufacture thin-film-transistor liquid-crystal displays (TFT-LCDs). While TFT-LCDs were used in applications such as pocket TVs in the late 1980s, it was not until laptop computers took off in the early 1990s that the TFT-LCD industry reached $1 billion in revenues. By the end of the 1990s, it grew to $10 billion dollars, as desktop monitors added to the demand from laptops.

It was not until 2002 that LCD revenues passed those of CRTs, but the first decade of the 21st century saw the takeoff of LCD TVs, driving the industry to the $100 billion dollar level in 2010. While "large-screen" LCD panels for TVs had been developed for years – for example, Sharp demonstrated a 14-in. panel in 1988 and a 29-in. version in 1996 – mass production lagged by about a decade because it required large investments in manufacturing equipment and time to achieve sufficient levels of cumulative volumes produced. Because these investments meant that the cost of producing TV panels would be prohibitively high compared to that of CRTs, an application was required to justify the initial investments that ultimately enabled LCD-TV production. The application in this case was the laptop computer, for which LCDs had no effective competition. In addition, the cost of the panel could be built in to the overall laptop cost.

In 1964, the first plasma displays were demonstrated, but due to the fact that they consumed large amounts of power and were only capable of low resolution and were relatively large, the technology had limited applications. Further development starting in the 1970s ultimately led to the introduction of 42-in. plasma displays in 1997. In the late 1990s and early 2000s, plasma filled a niche in the high end of the flat-panel TV business, and the plasma industry reached $1 billion dollars in 2002. However, investments in Gen 6 and higher plants enabled TFT-LCDs to overtake the plasma market in 40-plus-in. TVs, and plasma revenues peaked at $7.5 billion in 2006.

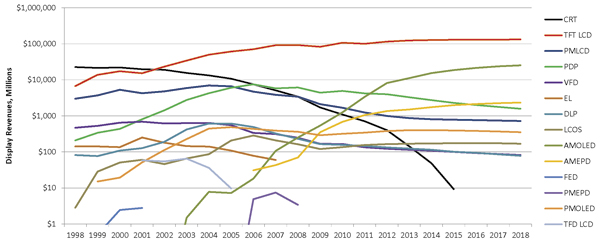

While work in organic electroluminescence had gone on for a few decades, conductive organic polymers were first reported in 1977, and the first OLED devices were developed by Kodak in 1987. In 1997, Pioneer began production of passive-matrix OLED (PMOLED) displays, and Sanyo-Kodak began producing active-matrix OLED (AMOLED) displays in 2002. In 2007, Sony began production of the first OLED TVs, 11 in. in diagonal. However, due to low production volumes and yield rates, along with high materials costs, the manufacturing cost of the display was prohibitively high (the retail price was approximately $1400) and the product did not succeed in the market. OLED makers, particularly Samsung, focused instead on small displays for mobile devices, which provided critical mass for the technology. Active-matrix OLED (AMOLED) revenues reached $1 billion in 2010 and are expected to pass $10 billion in 2013. This momentum has reinvigorated the development of large-sized panels for TVs; in early 2012, Samsung and LG Display demonstrated 55-in. OLED TVs and announced their intention to produce them within the year (Fig. 1).

Fig. 1: Numerous display technologies have been developed, and several have been produced in commercial quantities. The biggest transition to date has been the replacement of CRTs by flat-panel TFT-LCDs. Active-matrix LCDs, OLEDs, and EPDs are expected to see continued growth, while plasma, passive-matrix flat panels, and microdisplays are not expected to grow. (CRT = cathode-ray tube; TFT-LCD = thin-film-transistor LCD; PMLCD = passive-matrix LCD; PDP = plasma-display panel; VFD = vacuum fluorescent display; EL = electroluminescent; DLP = digital light processing; LCOS = liquid crystal on silicon; AMOLED = active-matrix organic light-emitting diode; AMEPD = active-matrix electro-phoretic display; FED = field-emission display; PMEPD = passive-matrix electrophoretic display; PMOLED = passive-matrix OLED; TFD-LCD = thin-film diode LCD.) Source: DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report.

Many other display technologies have been developed, including various forms of LCDs, other emissive technologies such as field emission and reflective technologies. The latter have been developed in the form of microdisplays, such as liquid crystal on silicon and digital micromirror devices, a type of MEMS technology. Direct-view reflective displays, which offer the promise of low-power operation, have taken many forms, with the most prevalent being electrophoretic; recently, direct-view MEMS and electrowetting displays have also come into the market.

Flat-Panel Market: Four Killer Apps

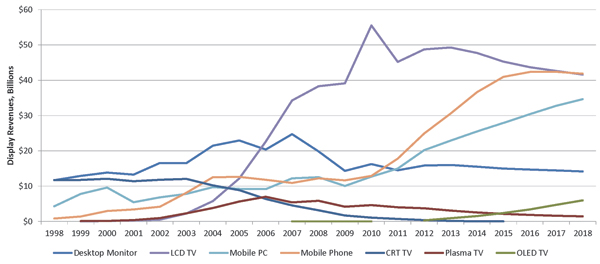

The first 15 years of the TFT-LCD industry were dominated by PC applications – first notebooks, then desktop monitors, the first CRT replacement market. The period 2005–2010 can be seen as the LCD-TV era, with tremendous growth due to replacement of CRT TVs (driven by shut-off of analog broadcasts and falling LCD prices) and growth in average screen size and sets per household worldwide. The value of LCDs sold for TVs grew from just over $12 billion to more than $55 billion during this period. The second decade of the 21st century is shaping up to be the mobile era – with mobile PCs (including tablet PCs) and mobile phones (driven by smartphones) expected to triple from less than $26 billion to over $76 billion. This growth will be shared between TFT-LCD and active-matrix OLED technology (Fig. 2).

Fig. 2: The display industry has grown around four key applications: TVs (first CRT and then flat panel), mobile PCs, desktop monitors, and mobile phones. Revenues for LCDs used in TVs peaked in 2010, but TV is likely to remain the dominant application due to growth in emerging markets. By the end of this decade, mobile applications are expected to pass TVs in terms of revenues. Source: DisplaySearch Quarterly Worldwide FPD Shipment and Forecast Report.

Growth of Flat-Panel Production: Geographies and Generations

While most of the fundamental developments in flat-panel-display technologies during the 1960s and 1970s were made in the U.S. and Europe, nearly all of the companies where the breakthroughs occurred – such as RCA and Westinghouse – chose not to pursue them, despite their being in the TV and other electronics businesses. In the 1980s and 1990s, several start-up companies were formed to try to commercialize flat-panel technologies in the U.S., but none were able to move into mass production and compete in the global market. Philips and Thomson built some production in Europe, but did not become significant manufacturers in their home bases; Philips had significant presence through joint ventures with Hosiden in Japan and then LG Electronics in Korea, but eventually exited the display industry.

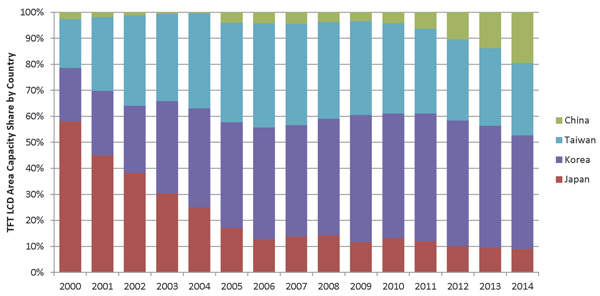

In the 1990s, the flat-panel-display business was dominated by Japanese LCD makers, led by Sharp, NEC, Hitachi, and DTI – a joint venture between IBM Japan and Toshiba – followed by several other Japanese firms. Korean companies identified TFT-LCD as a key technology due to its potential to replace the CRT and its overlap with semiconductor manufacturing, both important businesses to these firms. Taiwanese companies viewed TFT-LCD as a critical component technology for personal-computer assembly, the most important business for those companies. While Korean and Taiwanese firms began production of TFT-LCDs in the mid-1990s, their ability to invest was curtailed by the financial crisis that impacted Asia in 1997. By 1999, these companies had re-structured and were investing rapidly in TFT-LCD production. At the same time, most Japanese companies pulled back on TFT-LCD investments in the late 1990s, as an extended economic slowdown took hold. Instead, some Japanese firms entered into technology transfer/ supply agreements with emerging Taiwanese manufacturers (Fig. 3).

Fig. 3: After dominating TFT-LCD production throughout the 1990s, Japanese companies did not invest at the same pace as Taiwanese and Korean companies, leading to Japan losing its number one position in 2003. Samsung and LG Display have emerged as the dominant manufacturers over the past decade. Source: DisplaySearch Quarterly FPD Supply/Demand & Capital Spending Report.

Throughout the early 2000s, Korean and Taiwanese production grew very rapidly, and production from the two countries was evenly matched. In 2003, Korea emerged as the top supplier of TFT-LCDs, a position it has held ever since. The global economic slowdown that started in 2008 had a particularly strong impact on Taiwanese suppliers, as their lack of vertical integration meant that they were relegated to second-source status by brands that had their own panel production. While there was some development of TFT-LCD production in China in the early 2000s, some via joint ventures with Japanese makers, the country only began to emerge as a significant source of supply in 2011 and is expected to pass Japan in terms of capacity in 2012.

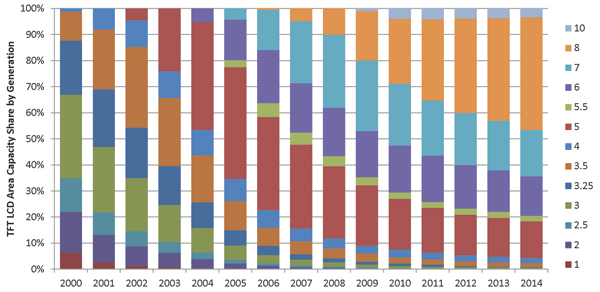

The manufacturing infrastructure for TFT-LCDs has proceeded fairly steadily in the first two decades of mass production, with a new "generation" of fabs (defined by a range of substrate sizes) coming into being every 2–3 years. Generations 1–3 were centered in Japan in the 1990s, but starting with Gen 4 in 2000, and in particular Gen 5 in 2002, Korean and Taiwanese firms took the lead. While Sharp was the first firm to start production in Gen 6 in 2004, Korean and Taiwanese firms quickly passed Japan in production. Like Gen 5, Japanese firms skipped Gen 7, and Sharp was first to start Gen 8 production in 2006, maintaining a lead for 2 years until Korean firms built multiple lines in 2008 (Fig. 4).

Fig. 4: Production of TFT-LCDs has proceeded along generations, which are defined by a range of substrate sizes. Every 2–3 years, a new generation is developed, with multiple factories and a common supply chain. Expansion past the Gen 10 is uncertain. Source: DisplaySearch Quarterly FPD Supply/Demand & Capital Spending Report.

Sharp once again was the first to build a Gen 10 line, in 2009, but this time no other firms have followed. While the huge substrate size (2880 x 3130 mm) can produce six 70-in. panels, the demand for such large screen sizes has so far been insufficient to justify even one factory, and the Gen 10 must compete with multiple Gen 8 lines that can produce 52-in. panels at only a slightly lower rate (6 per sub-strate as opposed to 8 per substrate on Gen 10). Thus the cycle of a new generation every 2–3 years has at least temporarily come to a halt.

The Next Era

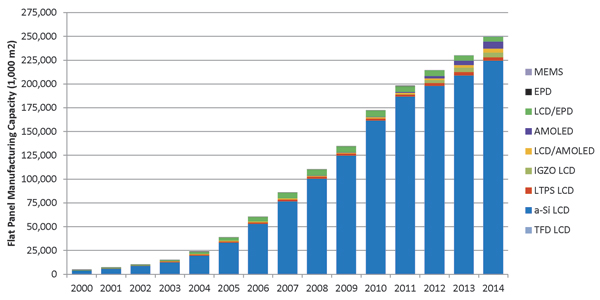

It is likely that most investment over the next several years will be in Gen 8 TFT-LCD production, particularly in China, and in technologies other than the standard a-Si TFT, particularly LTPS and IGZO, mostly for AMOLED but also for LCD. However, the installed base of 20 years of a-Si TFT-LCD capacity will make it the dominant technology for years to come (Fig. 5).

Fig. 5: Flat-panel-display manufacturing is dominated by a-Si TFT-LCD. However, much investment going forward will be in other forms of TFT, such as LTPS and IGZO, which can be used for OLED as well as LCD. Source: DisplaySearch Quarterly FPD Supply/Demand & Capital Spending Report.

Over the past decade, TV has been the driving force for flat-panel investments. Entry of multiple suppliers and the similarity of the panels have driven down prices, and combined with very high investment cost, has resulted in low or negative profitability for panel makers (taken as a whole, the TFT-LCD panel industry lost money during the second half of 2010 and throughout 2011). While TV will continue to be a key market, and the largest measured by area demand, it is likely that in the second decade of the 21st century, high-performance displays for mobile applications will be the area of focus. A key driver is the ability to view high-information-content information – particularly data and video – under a variety of conditions. This requires high resolution, wide viewing angle, and broad-color-gamut performance in a very slim package that consumes little power.

A related characteristic of these applications is that they tend to require customized designs, which enables panel makers to differentiate their products and compete less on price. However, this type of demand calls for different manufacturing investments and could result in the adoption of new technologies; for example, flexible form factors. It is likely that the industry structure will change along with the shifts in market demand and technology, but if history is any guide, such structural changes will take years to come about. •

Paul Semenza is Senior Vice-President, Analyst Services, for DisplaySearch. He can be reached atpaul.semenza@displaysearch.com.