China Continues to Expand Display Operations

China Continues to Expand Display Operations

The country’s recent economic setbacks have done little to slow the progress of new fabs in China.

by Jenny Donelan

ONE of the biggest trends from Display Week 2015 was how the Chinese panel makers stole the show in terms of big TVs. In our review of last year’s event, we wrote: “This was the first year at Display Week ...that products from China made such a strong appearance at the show. These companies have made real progress in recent years in terms of innovation. Among the many worthy Chinese firms in the exhibit hall (including the Innovation Zone) were certain standouts, including BOE, CCDL, CSOT, and SuperD.”

Since that time, the Chinese economy, until recently one of the most rapidly growing in the world, has faltered. According to a recent article in The Wall Street Journal, at the end of 2015, China was preparing to report its slowest annual economic growth rate in 25 years. Two of the major factors behind the slowdown are industrial overcapacity, especially in terms of commodities such as steel and glass, and also an oversupply of unsold homes in less economically developed cities.1

The overall economy might be expected to affect the display industry in China in at least two ways. First, a country struggling with industrial overcapacity might shelve plans for previously announced fabs. Second, in an economic downturn, consumers would be expected to spend less than previously on items such as TVs and cell phones.

In fact, as of this writing, local governments in China were continuing with those plans to build new fabs. And Chinese citizens were still the primary customers for TVs made in China. It sounds puzzling, but here is what’s going on, according to a number of experts both inside and outside the display industry.

Fab Stats

According to David Hsieh, Director of Analysis and Research for research firm IHS Technology Group, Chinese flat-panel makers have been ambitiously expanding their capacity for several years now, and the pace is not slacking. In a December 2015 blog post titled “China to have 28 flat-panel-display fabs in 2018. Long-term oversupply?”, Hsieh writes: “Panel makers such as BOE, China Star, CEC-Panda, Samsung Display, and LG Display are investing in Gen 8 fabs in China. Newcomers such as HKC are also investing in Gen 8, as this is currently the best generation line for TFT-LCDs. Although Gen 10 is the biggest line, both the Chinese government and makers have recognized the huge risk and narrow product mix available from Gen 10. Therefore, the focus has been primarily on Gen 8 investment ...The majority have been a-Si TFT-LCD fabs, especially for Gen 8 (2250 × 2500 mm), which is also called Gen 8.5 in China.”

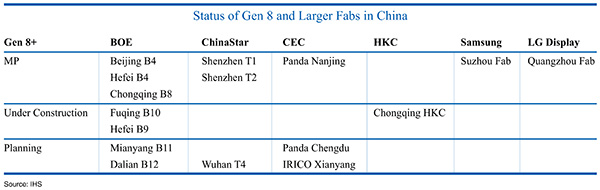

Hsieh also notes that based on current investment plans and existing facilities under construction, there should be at least 28 fabs in China by 2018. About half of those are Gen 5.5 and 6, and the other half are Gen 8 or larger, as shown in Fig. 1.2

Fig. 1: BOE, China Star, CEC, HKC, LG Display, and Samsung (the last two are Korean companies) all have Gen 8 and larger fabs in China that that are either built, under construction, or in planning stages. BOE is currently on track to have seven Gen 8+ fabs in China.

At least one exception to the 8.5 trend is BOE, which recently announced that it was partnering with Corning to build a Gen 10.5 LCD fab in Hefei, about 2 hours from Nanking. According to a recent report in Tech News, BOE plans to allocate the production of 65- and 75-in. super-large TV panels to this Gen 10.5 fab. The report adds that the investment is being made to take advantage of the rising market acceptance of large-sized TVs in China and will help the company

gain market share in this segment.3

A Part of the Solution

Dr. Qun (Frank) Yan, Committee Chair of SID’s Display Training School, Chief Technology Advisor for Changhong Electric Group, and expert on China, notes that although it seems surprising that Chinese companies are investing so heavily in display fabs during the economic downturn, the factories are considered part of the solution to the downturn. “Local government policies support this activity and funding is already allocated,” says Yan. Building TFT fabs is considered a way to help the local economy, he explains. Economic development is not very balanced across China, and some regional local governments are competing to host next-generation large TFT-LCD fabs, so this development is unlikely to be curtailed.

Hsieh’s blog explains in more detail why provincial Chinese governments are so eager to support LCD fabs built in their cities. One reason is stock growth: Panel makers’ share prices generally increase from new investments, which in turn helps the local government or capital fund under the government’s surveillance gain profits. Another is tax gains: Revenue from a new fab equates to tax gains on revenue tax or the VAT (Value Added Tax) for local governments. Real estate is another motivator. The government is the biggest owner of land resources in China, and land does not generate profit unless it is used productively. With new fabs built on that land, not only do employment and business activities create prosperity, but higher land value represents a better tax income for the local government. GDP growth is important, explains Hsieh, because China is “a special economic entity in which investment accounts for a large share of the GDP, rather than consumption. In fact, local government performance is judged by GDP growth because the central government values the nation-wide GDP as an important index for the country’s development. Government officials are rewarded for their efforts in growing the GDP of their cities.” Big LCD investments can stimulate that GDP growth.

According to Robin Wu, Principal Analyst with IHS DisplaySearch China, while the country’s current TFT-LCD capacity is certainly growing, it is important to realize that it is already enormous. “The China mainland now boasts the #3 capacity in the world after Korea and Taiwan and will soon overtake Taiwan to become the second largest region with TFT-LCD capacities,” he says.

Consumer Side

What helps make the display economy so interesting in China is that it is a huge market for buying displays, not just making them. “China is the #1 market in the world for LCD TVs, LCD monitors, and smart phones,” Wu says, adding that despite recent setbacks, “there is still steady economic development and a growing population with the ability to spend money in China.”

A recent article in the Financial Times, “China slowdown belies consumer market health,” acknowledges that consumers are still spending, but that many analysts are skeptical of recent government reports that retail sales were growing at an annualized 10% in mid-2015. The article noted that succeeding in China’s consumer economy is not as easy as it once was. Companies need to work harder and smarter, whether by offering less-expensive products to less-affluent customers or by improving the products and services they offer to high-end customers. Displays obviously can be targeted to both ends of the market.4

Says Yan, “Domestic supplies of panels still cannot meet the full demand in China. Most products made in China target the domestic market, and current fab

capacities are not yet large enough to feed ongoing consumer-product demands. Currently, some of the highest-end TVs (4K) come from Korea and Taiwan. But that is going to change very quickly.”

Of course, at some point the Chinese consumer market will become saturated with TVs, mobile phones, and other devices, much as markets have in North America and Europe – just not quite yet, it seems.

Display Talent from China

This relative affluence affects the Chinese display industry from an additional angle – academic research. Shin-Tson (ST) Wu, a professor with the College of Optics and Photonics at the University of Florida, notes that his college receives more than 100 Ph.D. applications each year from China alone. “In the early 2000s,” he says, “the Chinese economy was still developing. So, if we offered a student admission without a scholarship, that was equivalent

to rejecting the applicant.” Now, however, many admitted Chinese students attend without financial support.

Another trend, he adds, is an increase in visiting scholars, including graduate students and faculty, who come with Chinese government funding. These visits can span from 6 months to 2 years. The trained display scientists who return to China to work will strengthen the R&D side of the industry.

Show Products

It is intriguing to wonder what kinds of products the Chinese companies that brought the big TVs to Display Week 2015 will offer the show this year. A look at CES 2016, only a few weeks away at press time, may offer hints. Show previews mentioned pending announcements from Chinese display companies such as Lenovo (monitors, device touch panels), Huawei (smartphones), and Hisense (TVs). To read more about Hisense’s recent acquisition of Sharp’s North American LCD-TV business, see Industry News in this issue.) According to CNBC, CES 2014 had 871 tech firms from China, a 34% jump from 2012, when there were 648 Chinese companies.5

Nothing is certain, of course, when it comes to any country’s economy, and China’s is unique in terms of size, scope, and recent acceleration (the current

downturn notwithstanding). It is exciting, however, to see that the pace of display development has continued, despite stumbles from the overall economy. The editors at Information Display think there is a very good chance that we will be standing in front of more big, beautiful displays from China at this year’s show in San Francisco.

References

1www.wsj.com/articles/china-set-to-unveil-economic-blueprint-for-2016-1450691139

2http://blog.ihs.com/china-to-have-28-flat-panel-display-fabs-in-2018-long-term-oversupply

3http://technews.co/2015/12/03/boe-partners-with-corning-to-build-the-worlds-largest-gen-10-5-lcd-panel-fab-in-hefei-trendforcereports/

4http://www.ft.com/cms/s/0/6b876934-4bd3-11e5-9b5d-89a026fda5c9.html#axzz3vgDQHwU2

5http://www.cnbc.com/2015/01/08/record-breaking-number-of-chinese-firms-at-ces.html •

Jenny Donelan is the Managing Editor of Information Display

Magazine. She can be reached at jdonelan@pcm411.com.