Materials Matter

Display Week 2014 Review: Touch Technology

Display Week is the single best place in the Western hemisphere to see and learn about touch technologies.

by Geoff Walker

EMBEDDED TOUCH, touch controllers, the latest stylus technologies, and much more were to be found at Display Week 2014 in San Diego. As will be mentioned later in this article, some of the information was difficult to obtain, due to increasing secrecy on the part of display makers. But, all in all, the show was an excellent and, in fact, unparalleled place to learn about touch.

All of the six major display makers at Display Week 2014 either showed examples of embedded touch (AUO, JDI, LG Display, and Tianma) or acknowledged that they

have developed embedded touch but chose not to show it this year (BOE and Samsung). Although high-volume shipments of embedded touch started only 2 years ago,1 embedded touch has rapidly become a broadly accepted technology. In a conversation with the author, JDI Chief Strategy Officer and Deputy Chief Technology Officer Hiroyuki Ohshima expressed the opinion that all display makers are doing some form of embedded touch for revenue and profitability reasons.

While there were several interesting new disclosures of embedded touch on the show floor, in general the author has seen a steadily decreasing flow of public

information over the last year regarding what the display makers are actually doing with embedded touch. The author’s opinion is that the competition between the display makers and the discrete touch-panel makers is intensifying, with the result that the display makers are becoming much less open about their new developments in embedded touch.

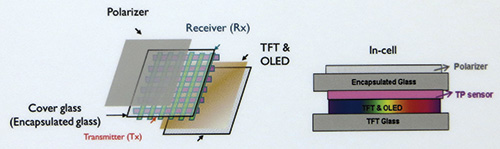

Probably the most interesting new embedded-touch exhibit was AUO’s “in-cell OLED.” The p-cap touch sensor in the two examples shown by AUO (1.6 and 5 in.) comprised two layers of ITO deposited on the underside of the OLED encapsulation glass (Fig. 1). The primary reason for this location (rather than on top of the glass, as with Samsung’s technology) is to allow thinning of the glass. In theory, the glass could be thinned down to 100 µm. (Thinning the glass is done by mechanical abrasion or some form of chemical etching. If there are touch electrodes deposited on top of the encapsulation glass, the glass cannot be thinned.) The 10-point 120-Hz touch sensor is less than 1 µm thick, and there is an air gap of a few microns between the touch sensor and the top of the OLED. The entire display is less than 0.6 mm thick. AUO acknowledged that the touch sensor could have just as well been constructed with a single layer of ITO with bridges. Actually, it is arguable whether this is truly “embedded touch” or not. Embedded touch is supposed to be something that only a display maker can do; the deposition of the touch sensor on the encapsulation glass can be done by a discrete touch-panel supplier. It’s analogous to the way a discrete OGS touch panel is created on an LCD cover glass.

Fig. 1: AUO’s in-cell OLED puts a p-cap touch sensor made up of two layers of ITO on the underside of the OLED encapsulation glass in order to allow thinning of the glass before attaching the polarizer. The thickness of the sensor layer is less than 1 µm; the thickness of the entire display is less than 0.6 mm. Artwork by AUO; photo courtesy Geoff Walker.

However, this is the first time the author has seen a p-cap touch sensor positioned only a few microns away from an OLED. In discussing this, AUO pointed out that the electrodes on top of the OLED act as a shield for the OLED’s TFT backplane, with the result that the touch sensor actually sees less noise than in an LCD. AUO also said that the large parasitic capacitance of the OLED top electrodes was not a problem due to “clever OLED driving that’s optimized for touch-sensing” (sounds like a trade secret!).

Other AUO touch exhibits included a 5.5-in. in-cell FHD touch panel, a 6.1-in. on-cell touch panel, and a 7-in. direct-bonded discrete touch panel for automotive applications. Finally, AUO showed a very clever 2.4-in. (54 × 32 mm) fingerprint-sensing technology based on a-Si optical in-cell touch (Fig. 2). The sensor is basically a display backplane without pixel drive electronics, so the entire pixel (one TFT in each cell) can be used for optical sensing (the resolution is 508 ppi). AUO’s initial target market is governments, which tend to require multiple-finger sensors. In the author’s opinion, AUO was clearly the best touch exhibitor at Display Week 2014.

Fig. 2: AUO’s 508-ppi fingerprint sensor shows the author’s left index fingerprint. The sensor is basically a display backplane without pixel drive electronics, so the entire pixel can be used for optical sensing. Photo courtesy Geoff Walker.

LG Display showed a 5-in. HD oxide display with in-cell touch with an accuracy of <1.0 mm and a reported rate of 120 Hz. The touch function was combined with the display driver function in a single touch display driver integration (TDDI) chip. Although it was not demonstrated, the touch function was also supposed to

support hover and glove touch. The touch function was specified as having a “touch finger separation” of 1.0 mm, which is not really good enough. From the user’s perspective, it is unreasonable to expect someone to hold their fingers at least 1 mm apart in order to register two distinct touches. More than half of the p-cap touch panels that the author has tried in the last year were able to reliably detect two fingers held tightly together as two distinct touches; in the author’s opinion this is now the de facto standard. The performance of LG Display’s in-cell touch with a rapidly circling passive stylus was decent, although it was clear that the controller was dropping some points and failing to meet its claimed 1-mm accuracy.

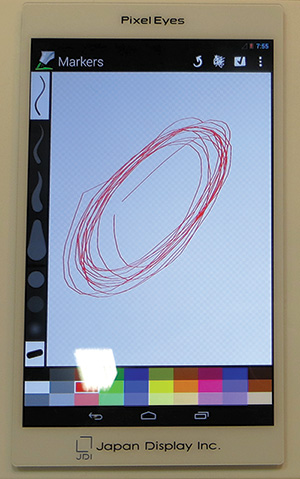

JDI showed two versions of “Pixel Eyes,” its branded embedded-touch technology. One was exactly the same as shown at Display Week 2013,2 even down to the 2013 date on the sign; the other had considerably improved performance – although it still dropped a few points during very rapid drawing with a 1-mm-tipped passive stylus (Fig. 3).

Fig. 3: JDI’s “Pixel Eyes” hybrid in-cell/on-cell touch was demoed on a 7-in. 1200 × 1920 (323 ppi) LCD. The circles on the screen were drawn rapidly by the author with a passive stylus. The irregularities in the lines indicated some dropped points – although, overall, the performance seemed slightly better than that of LG Display’s in-cell touch. Photo courtesy Geoff Walker.

The JDI executive mentioned at the beginning of this section also made the following comments:

• JDI plans to stick with hybrid in-cell/on-cell construction rather than moving to on-cell or true in-cell. Hybrid construction has high sensitivity, it works well with a fine-tipped passive stylus, the manufacturing process has been perfected so that it can be produced with high yield, and it can be scaled easily. (This answer of “we’re sticking with what we know” is the same reason that many discrete touch-panel manufacturers give for sticking with a particular stack-up such as GFF, G1F, or GG. Once one gets good at something, there is a lot to be said for continuing to leverage it even though other alternatives are available.)

• JDI is definitely going to use Pixel Eyes in a 10-in. tablet. There are no technical impediments; all the engineering and manufacturing problems have been solved, so it is just a matter of business strategy. JDI is currently delaying introducing a product in order to make sure that it has a fully differentiated solution. In any case, the solution will definitely include a fine-tipped passive stylus.

• JDI believes that it could definitely produce a 13.3-in. display with Pixel Eyes (i.e., for use in an Ultrabook), but it does not participate in that market and does not know the market requirements. Plus, JDI also views the touch-notebook market as being too small. So even though it is technically possible, it is unlikely that JDI will use its hybrid in-cell/on-cell embedded touch technology in displays larger than 10 in.

Tianma showed two prototypes of its latest two-layer in-cell touch (6.5 in. for phablets and 1.54 in. for wearables). Tianma’s controller partners for in-cell are FocalTech and Synaptics. The smaller touch panel was rated for five points, which seems a bit like overkill on a screen that small. The great majority of Tianma’s touch was shown as discrete p-cap touch panels, labeled “CTP” for “capacitive touch panel.”

Touch Controllers

The most pervasive touch trend on the

Display Week floor can be summarized in four terms: water resistance, glove touch, hover, and passive stylus. The majority of all touch-panel and touch-controller exhibitors were showing one or more of these new characteristics. The entire touch industry has been doing development on these four characteristics for the last 18 months, and now it is done. All four are being rolled out into the real world. Because the touch portion of the Display Week exhibits had a strongly commercial-industrial slant, many of the demonstrations were in a commercial frame of reference. But there are consumer products on the market right now (mostly in Asia) that support one or more of these four characteristics.

The most “fun” demonstration of water resistance was in the UICO (duraTouch brand) booth (Fig. 4). A p-cap touch tablet running a software-based radio application was positioned under a shower head; with the water running, all of the touch controls on the tablet could be manipulated as though the water did not exist.

Fig. 4: UICO’s fun demonstration of water-resistance for p-cap touch was about as graphic and

clear as it could be. UICO achieves this very high level of water resistance by writing its own touch-controller code, but similar results have been accomplished by the major suppliers. Photo courtesy Geoff Walker.

Most often, water resistance is achieved by operating a touch panel in two modes and switching back and forth between them. The modes are (1) self-capacitance (using only the top electrode layer) and (2) mutual capacitance (using both electrode layers). Self-capacitance is unaffected by water, while mutual capacitive sees water as a touch.

Solomon Systech, a Hong-Kong-based touch-controller supplier who sells mainly into the China white-box market, demonstrated water resistance using only algorithmic support on a 4-in. true single-layer (“caterpillar pattern”) mutual-capacitance p-cap touch panel. This is a significant achievement because it is very difficult to distinguish water droplets from touches using only mutual capacitance. I asked if perhaps the Solomon Systech controller was using only a portion of

the single-layer electrode in self-capacitance mode, and the booth representative insisted that the water resistance was accomplished purely via mutual-capacitance algorithms running on the touch controller.

True single-layer mutual-capacitance touch panels have rapidly become the configuration of choice for low-end smartphones due to their low cost; Solomon Systech’s ability to support more advanced functionality such as water resistance purely through mutual-capacitance firmware provides an interesting illustration of how the capability of p-cap touch is continuing to expand even at the very low end.

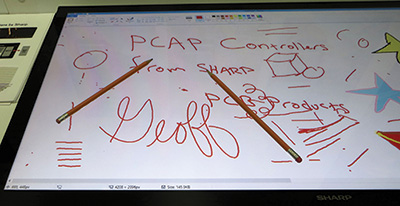

Probably the best of many demonstrations of passive stylus on the show floor was in the Sharp booth. In mid-2013, Sharp entered the merchant touch-controller business with a line of p-cap touch controllers that handles from 5 to 100 in. At Display Week 2014, Sharp was showing a 4K 32-in. LCD with a standard p-cap

sensor and two #2 pencils (Fig. 5). The two pencils worked perfectly as styli, with the exception of the awkward and slow mode switch between stylus and finger touch (Sharp’s firmware still needs some tuning.) In fact, the eraser on one of the pencils (the more worn-down one) even worked as a stylus. The touch controller for the 32-in. display consisted of one analog chip and one digital chip. For larger displays, additional analog chips are slaved in increments of 20 in.

Fig. 5: Sharp demonstrated a 4K 32-in. LCD running its new touch controller with a standard p-cap sensor and two #2 pencils as passive styli. As the photo indicates, the pencils worked perfectly. In the last 18 months, the #2 pencil has become the de facto passive stylus that all the touch-controller makers use to prove that they have high SNR.

Sharp is one of the few controller companies to explain at least one of the ways it achieves the very high SNR necessary to support a #2 pencil as a stylus.3 The secret is “parallel drive.” It is commonly believed that a p-cap touch controller works by applying a signal to one drive electrode, and then reading the capacitance at each of the intersecting sense electrodes – i.e., that it uses a sequential driving method. In reality, almost all touch-controller companies are driving multiple-drive electrodes at the same time and reading multiple intersections at the same time. In doing p-cap touch sensing, time and signal amplitude are critical. The more things that can be done in parallel, the more time is available for additional sensing cycles. And, when more electrodes are driven at the same time, the measured signal (output) increases. This effectively increases the SNR, which enables detection of very small touch objects such as the tip of a #2 pencil, even on larger screens. Most touch-controller suppliers keep the details of parallel drive as a trade secret and never talk about it. Apple published some details in a patent.4

Other touch-module and touch-controller suppliers who were demonstrating at least one of the four new p-cap characteristics (but have not been mentioned yet) included AMT, Emerging Display Technologies, EETI, FocalTech, and SMK.

Touch Sensors

The most significant trend in touch sensors is the move to true single-layer mutual-capacitance sensors. This trend is fundamentally driven by cost pressure and by the reality that very few products or applications require more than two touches, especially at the low end. This trend is most obvious in Asia, where more low-end phones are sold. Only a few touch suppliers were showing single-layer sensors at Display Week 2014 (e.g., Solomon Systech) but several more acknowledged the trend in conversations with the author (e.g., JDI).

Another touch-sensor trend that is growing but has not reached widespread consumer-electronics products yet is plastic (PMMA) cover lenses. Touch suppliers showing touch panels with PMMA top surfaces at Display Week included Dawar, Emerging Display Technologies, and Gunze. The primary issue that is keeping big consumer-electronics OEMs from using PMMA on phones and tablets is the deformability of the material. PMMA can be made very scratch resistant (up to 9H, as shown by Fujitsu), but it cannot be made so that a child with a ballpoint pen cannot damage it. The author believes that eventually one big OEM will switch to PMMA, then others will follow once someone’s broken the ground, and then everyone will become used to the dentability of the material. After all, we all lived with resistive touch panels on our pen computers, PDAs, GPSs, Microsoft tablet PCs, and other devices (PET top surface, easily damaged) for more than 20 years!

Active Stylus

Hanvon was the only active-digitizer vendor exhibiting at Display Week. It was showing its standard battery-less Electromagnetic Resonance Touch (EMT-branded) product line, but it was a very low-profile exhibit. The most interesting statement made by a Hanvon representative was that the company has decided to take on the role of p-cap stylus ODM for suppliers such as Atmel, Synaptics, ELAN, etc. There is a distinct need for this in the market; none of the touch-controller

suppliers (other than N-Trig, which was not exhibiting) want to be in the business of building active styli, and there are very few specialized manufacturers to whom these suppliers can turn.

The Hanvon representative told the author that although Hanvon suggested the possibility of a single stylus design that would work with all three brands of touch controllers, all three of the abovementioned suppliers rejected the idea (presumably because of revenue concerns because extra styli are a very high-margin accessory). Hanvon said that it is currently developing a “true battery-less stylus that derives its power from the touch-panel drive signal” – i.e., no battery and no supercap. The frequency hopping that most touch-controller manufacturers use make this a little more challenging than it seems at first glance.

Hanvon was demonstrating one of its active styli that is designed to work with the FocalTech controller; the stylus was powered by a AAAA battery. If Hanvon wants to be successful as a stylus ODM, it is going to have to demonstrate a much better grasp of human factors than was evidenced in the FocalTech stylus – it was much too slippery, the button was too long and too close to the end of the stylus, and the writing experience did not replicate a pen-on-paper feeling.

The astute reader may notice that there are frequent mentions of passive stylus throughout this article, but this section contains the only mention of active stylus. The reality is that passive stylus is getting so good (as a result of continuously increasing touch-controller SNRs) that it is approaching “good enough.” Stylus tips are now all in the range of 1.0–2.0 mm, and the tips are made of a harder material that produces a much more pleasant user experience than the old rubber-tipped styli.

An active stylus still provides three main advantages: (1) higher resolution, (2) pressure-sensing, and (3) hover. However, the author believes that the #1 advantage will disappear as touch-controller manufacturers continue to tune the algorithms that support passive stylus. Advantages #2 and #3 will both disappear if the touch industry finds a way to build high-quality pressure sensing into the p-cap sensor (rather than put it the stylus). Apple has started the ball rolling with the pressure-sensing technology in its Apple Watch; on its Web site5 Apple claims that “[Force-sensing] is the most significant new sensing capability since multi-touch.” Hype aside, in the author’s opinion, Apple’s technology is best-suited for watch-sized displays and does not scale well to phones and tablets. The author recommends watching for an announcement from Cambridge Touch Technologies, a tiny UK start-up that has invented an elegant, scalable, and manufacturable method of adding high-quality pressure-sensing to any p-cap touch-panel stack-up, without changing any characteristic of p-cap.

ITO Replacements

Transparent conductive material that can replace ITO in touch panels has been a very hot topic for at least the last year. However, the exhibits in this technology area at Display Week 2014 were surprisingly tame. Probably the most interesting was Cima NanoTech, which showed a 26-in. curved touch panel and what it claimed was the industry’s first 42-in. film-based non-ITO touch module. Actually, there have been film-based p-cap touch screens made with 10-µm wire around for many years, but it is clear that Cima means “made from modern ITO-replacement materials,” which in this case means self-assembling silver mesh.

Other ITO-replacement material suppliers exhibiting included the following (in alphabetical order):

• Canatu: Roll-to-roll printed carbon nanotube (Carbon NanoBud brand) on PET film. This material won the SID Display Component of the Year Silver Award at Display Week 2014.

• Carestream Advanced Materials: Roll-to-roll solution-processed silver nanowires on PET film (FLEXX brand). Films such as these are “drop-in” replacements for ITO, designed to fit the existing processes with minimum disruption. The problem is that disruption is what usually changes things (e.g., printed metal mesh where deposition and patterning of the transparent conductor are done simultaneously).

• Oxford Advanced Conductors: Silicon-doped zinc, similar to ITO but lower cost, solution-processed, more available, and greener. These are all good characteristics, but they are not focused on what the touch industry wants most: very low sheet resistivity and very high transparency.

• Poly IC: Roll-to-roll printed metal mesh on PET film. With a minimum conductor width of 8 µm, the mesh is not competitive with the current 2–4-µm range found in Asia.

• Rolith: Photolithography equipment capable of making metal mesh with < 1-µm conductor width, < 5 Ω/□, and > 95% transmission. Rolith’s estimation of mesh sensor cost (on its equipment) at the end of 2015 is $15/m2; the author’s estimate of where the market will be is $10–12/m2.

Other Touch Technologies

There were three notable examples of non-p-cap touch on the Display Week show floor. The biggest was LG Display’s 98-in. UHD interactive whiteboard (Fig. 6). The touch technology was not labeled, but close inspection revealed it to be

10-point multi-touch infrared. The latency of this touch system was one of the worst that the author has seen – it was at least 0.5 sec. When the ink written on a whiteboard takes a half-second to appear, the lag is so disconcerting that it makes the whiteboard essentially unusable. It seemed fairly clear that the touch system was probably added as an afterthought, and that LG Display was mainly focused on showing off its 3840 × 2160 resolution and 98-in. diagonal. Note that the resolution calculates to only 42 ppi.

Fig. 6: The touch response of LG Display’s 98-in. interactive whiteboard was slow at 0.5 sec. It handled 10 touches quite well; the 10 short lines just to the left of the long straight line were created by the author’s two hands. However, the touch system’s ability to separate two closely spaced fingers was not very good. The two sets of two parallel intertwined lines at the lower right of the long

straight line were created by the author holding two fingers about 10 mm apart. The intertwining indicates that the touch system cannot decide if it is seeing

one or two touches. Photo courtesy Geoff Walker.

The second notable example of non-p-cap touch on the show floor was AD Metro’s 24-in. glass-film-glass (GFG) 5-wire resistive touch panel. Twenty-four inches is the largest resistive touch-panel the author has ever seen, and it looked great. An AD Metro booth representative said that the typical applications for this size included military and shipboard control panels.

The final notable example of non-p-cap touch was Panjit’s analog multi-touch resistive (AMR). This touch technology has become very rare (specialized) as a result of the onslaught of capacitive touch. The sensing element (square) of the sample on display was about 12 mm; this is just small enough that it is difficult to get two fingers onto one element, but not so small that the pinout count becomes unmanageable. A Panjit booth representative said that the typical applications for its AMR are military and industrial and that “healthcare that is not happy with all the characteristics of p-cap” (interesting!).

More Touch Than Could Be Taken In at Display Week

As has been the case since at least 2010, there was a huge amount of touch-related technology to be seen on the show floor. Studying it all required more than one full day. And, as always, there were competing touch-related events such as the touch sessions in the Symposium on Tuesday and Thursday, the touch session of the Exhibitors’ Forum on Tuesday, the Touch-Gesture-Motion Market Focus Conference on Wednesday, and the touch posters on Thursday. And that’s not even mentioning the Touch Short Course on Sunday and the Touch Seminar on Monday. Display Week remains the single best place to see and learn about touch technologies in the Western hemisphere.

References

1http://informationdisplay.org/IDArchive/2012/September/DisplayWeek2012ReviewTouchTechnology.aspx

2http://informationdisplay.org/IDArchive/2013/SeptemberOctober/Touch.aspx

http://techon.nikkeibp.co.jp/english/NEWS_EN/20130315/271452/

4http://www.freepatentsonline.com/y2009/0009483.html

5http://www.apple.com/watch/technology/ •

Geoff Walker is a Senior Touch Technologist at Intel. He was also Information Display

’s Guest Editor for Touch & Interactivity for 2007 and 2010 through 2012. He can be contacted at geoff.walker@intel.com; 408/765-0056 (office) or 408/506-7556 (mobile).