Enter the Feature-Driven Market

Enter the Feature-Driven Market

Enter the Feature-Driven Market

Faced with a consumer market that is reasonably content with current-sized panels and accustomed to ever-lowering prices, TV manufacturers are looking toward specialized features to drive sales – and profits – upward.

by Steve Sechrist

AS ALWAYS, TV panels were prominent on the show floor at Display Week this year. The TV market has become increasingly complicated, and for that reason a good

way to commence discussion of it is with some background data from the IHS/SID Business Conference, which also took place at Display Week 2016.

Speaker Paul Gagnon, analyst and Director of TV Sets Research at market research firm IHS, reported on the outlook of TV sales, noting that the global TV market

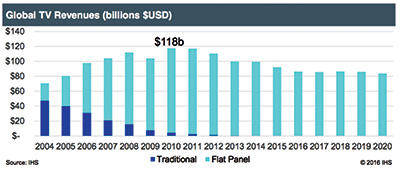

will continue to grow in unit volume though the current decade (at about the same level as the decade ending in 2010), reaching 250 million units by 2020. However, said Gagnon, “Revenues are not expected to improve, which is weighing on profits for many TV brands.” That revenue number peaked in 2010 at $118 billion and will decline to just over $80 billion by the end of 2016, remaining flat through the decade and ending 2020 at just over the $80 billion mark (Fig. 1).

Fig. 1: The best days of flat-panel revenues are already well behind us, according to IHS market data that shows the peak occurring in 2010.

According to Gagnon, set makers looking to increase profits can do so by targeting features that customers are willing to pay for. Such features include UHD, full color gamut, and HDR, despite the lack of available content or even standards in display quality to help drive this feature set forward. He also explained that although there has been a steady average size increase in the TV space over the last several years, this growth is slowing, which is also creating more focus on successful feature introductions. “Picture quality ranked No. 1 in [customer] decision criteria in all 14 countries surveyed,” he said, “across all types of regional demographics, with high resolution a “close second.”

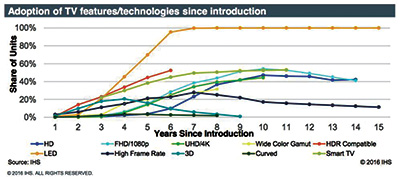

While the “picture-quality” category seems rather nebulous, in his presentation Gagnon identified several consumer benefits such as HD, smart TV, and LED backlighting, as well as full-HD/1080p resolution, considered table stakes in today’s worldwide TV market (see below). Going forward, we can expect to see UHD/4K, plus wide color gamut, HDR compatibility, and even 3D and curved sets as other options in the category. (Remember when a wireless remote was considered the sole upgrade to a color TV set?)

The survey also found that average TV price is a function of both product-specific and country-specific factors that include screen size, product features, brand,

retail environment, and margins, tariffs, taxes (VAT), inflation, and exchange rates. The good news for manufacturers: higher efficiencies are helping reduce panel price per inch (ppi), moving that number down from $15 (in 2016) to an anticipated figure below half of that (for base models anyway) within the survey period that reaches the end of this decade.

Another featured conference speaker, Robert O’Brien of RJO Options LLC, also reported that new product features for improved picture quality represent an increasing share of revenue for all major brands. (O’Brien based his presentation on his company’s recent brand report, which is based on point-of-sale data across hundreds of product categories in more than 90 countries.)

His company’s findings were slightly different from IHS’s: RJO’s mresearch indicated that smart TVs currently dominate the premium options,

representing more than half of all TVs sold. But 4K resolution has almost become a de facto standard in most markets. “It is on the path to mainstream adoption,” said O’Brien. He noted that other factors such as curved sets, color saturation, and OLED TVs were still emerging, yet likely to become increasingly important in terms of value. Figure 2 shows the relative success of some of these features to date, including 3D, high frame rate, and HDR.

Fig. 2: Features such as LED backlighting have fared well since its introduction, whereas the curved form factor has done little to spike unit shares thus far.

O’Brien also noted that while major features such as 4K and smart-TV capability are global in their appeal, local country markets do exhibit huge variations in

preferences regarding pricing, brand dynamics, and specific features. For example, “high prices are not necessarily found in high-income countries” he said, comparing the G201 average selling price (ASP) of $503 to Argentina’s $817 and $436 for the U.S.“ Low prices can be a result of a competitive environment among brands and retailers,” he explains.

Brand Dynamics

According to O’Brien, the TV market breaks down into three groups that represent >85% of the market: This includes four top global brands (Samsung, LG, Sony, and Panasonic) with a global presence. These typically lead major industry innovation and usually have an ASP above the industry norm. Brands including Sharp, Philips, Vizio, and Toshiba have regional strengths, and in some cases are market leaders in their territories, with average sakes prices (ASPs) at or near the industry average. The third group is represented by brands from China (“the Big 6”), which include TCL, Skyworth, Changhong, Konka, Haier, and Hisense. These companies’ products typically have ASPs below the industry average, O’Brien said.

LG Display OLED TVs Light Up the Show Floor

To make the case for features driving the future of TVs, one had to look no further than the exhibition floor at Display Week. First and foremost was LG Display, which demonstrated an impressive 77-in. OLED TV with HDR that drew crowds throughout the entire 3 days of the show (Fig. 3).

Fig. 3: LG Display’s 77-in. OLED panel with HDR was the first thing visitors saw when they entered

the show floor, and many of them stopped to gaze for a while.

This set (with a rumored price of $37K), helped the company win the large-booth Best-in-Show award, taking it away from BOE, which had won the award in the

previous 2 years for its innovative TVs.

LG Display went on record at Display Week to say that the future of TVs is the OLED TV (Fig. 4). To back up its claim, the company showed an impressive range of OLED-based TV prototypes, including a concave 65-in. UHD OLED, an OLED dual-view flat-display TV and an OLED transparent display, all representing plans for future products from the Korea-based TV maker.

Fig. 4: The future of TV is here and “It’s OLED, not LCD” proclaimed LG Display on the side of its booth at Display Week 2016. Photo courtesy Steve Sechrist.

My favorite LG TV panel in the group was the dual-view 55-in. OLED in full HD, with a thickness of just 7.9 mm and a tiny 6.6 mm (left, right) bezel, that

showed a unique OLED image on both sides. This will be quite useful in the digital out-of-home (DooH) market and other commercial B2B options. Another B2B TV candidate was a 55-in. OLED transparent display that LG said had 40% transparency. The TV operated in full HD (1920 × 1080) running at 120 Hz and 200-nit luminance. Finally, the UHD OLED concave display was 65 in.on the diagonal with 3840 × 2160 pixels and a 500-mm curvature radius.

LG Display also showed an LCD-based curved panel with WQHD resolution (that’s 3440 × 1440 pixels) with a whopping 109 ppi. The display was mounted on a wall in a three-panel landscape configuration (Fig. 5). The radius of the curvature was 1900 mm, and LG said it was using an a-Si backplane. This LCD is currently in mass production, according to the company.

Fig. 5: LG Display did show some LCD-based panels as well as OLED ones, including this WQHD-resolution curved display, shown here in a three-panel landscape configuration. Photo courtesy Steve Sechrist.

LG Display made the case that the best way to produce HDR images is by using OLEDs. LG said “OLEDs = The Best Solution for HDR.” And while the company may be right in the long term, as reported above in the Business Conference sessions, price and yields have yet to push OLED display technology anywhere near the volume (or low cost) of rival LCDs that still dominate mainstream TVs. So, for now, LG will continue to differentiate the high end of its TV product

line with its stunning display-quality WOLED panels in sexy razor-thin form factors, albeit at higher prices and presumably lower profit margins due to yield and production-cost issues.

Samsung Sticks with LCD TVs (at least at Display Week)

Samsung Display was also exhibiting at Display Week, showing off its high-contrast-ratio low-reflectance LCD technology. The company had a 65-in. UHD “Black Crystal” display that used global dimming to achieve the high contrast ratio and low reflectance for its panels in the booth on the exhibition floor. By using its SDC VA mode, the company achieved a 6000:1 contrast with just 2.3% reflectance.

Samsung said it will use this technology to help differentiate its product line and include its Slim D-LED local-dimming feature in the step-up models that

will be selling at a higher price. The company said the typical living room is at 131 lux and at that luminance level; its UHD display achieves a contrast ratio (CR) of 6K:1 (up from 1,500:1) with a remarkably low 2.3% reflectance (conventionally around 7-8%). That CR number boosts to 8K:1 in low-light levels (meaning dark or less than 1-lux rooms). Samsung will offer this panel with an edge-lit or local direct-dimming option to help support its good–better–best pricing model. On the curved side of LCDs, Samsung showed a 65-in. slim unit with UHD resolution.

Samsung’s TV-panel presence this year was rather muted, with very limited material, printed or on display, in the booth considering it leadership position in

worldwide markets. When we inquired about press meetings, they said none were planned at the show. One has to imagine that the company is working on something that cannot be revealed yet (see “Four Materials Stories from Display Week 2016” in this issue for some informed speculation on the company’s OLED-TV strategy).

Big Displays from BOE

BOE showed an 82-in. 10K (10240 × 4320) curved display, the same technology that helped the company take a SID Best-in-Show large booth award at Display Week last year. Specs for this newest 10K curved set include 136 ppi with a luminance at 360 cd/m2. The curved set offered a radius of 6,500 mm. Also impressive in the BOE booth was its massive 98-in.-diagonal 8K-resolution panel with HDR.

BOE claimed it could achieve black levels as low as 0.001 cd/m2 with a peak brightness at 1000 cd/m2 of luminance (a whopping six orders of magnitude higher). The company said its 98-in. behemoth was available now, but no pricing was included with that statement. A second 8K panel was nearby, this one a 65-in. model that was thin and sexy at 3.8 mm.

QD Vision’s TV-Panel Exhibit

One interesting show-floor exhibit from QD Vision featured the “Product Wall of Fame,” tracing the history of quantum-dot-enhanced LCD TV sets that have shipped since their first introduction in 2013. The world’s first ever title goes to the Sony KD-65X9000A, which was shown at CES in January 2013. At the time, Sony introduced its QD-based (edge-lit LED) “triluminous panel technology” that worked together with a powerful processor to boost RGB color.

Other notable sets included examples from Thomson and TCL that both achieved the widest color gamut (90% of Rec.2020) available in a commercial TV back in 2015.

In that same year, Philips gained the prize for the most energy-efficient commercial 55-in. QD set. China brand Hisense also made the QD Vision “Wall of Fame” with its K7100 model, the first ever curved QD-based LCD TV. This shipped in 2015.

A Challenging Market

So again, faced with a maturing consumer market that is reasonably content with current TV offerings, as long as they are selling for ever-lower prices, today’s TV makers are facing challenges. Each TV maker must look toward specialized features (curved, HDR, and OLED panels, to name a few) to help drive the next wave of sales – and profits – forward, lest it be relegated to the razor-thin margins at the bottom of the TV commodity space.

Intense competition from low-cost China brands continues to persist, as these relatively new panel manufacturers look to shift from a position as white-box

sellers to establishing their own worldwide brands that push the price/feature and display-quality boundaries ever forward. As this happens, we also expect to see continued consolidation in the space as some established TV brands decide the cost to play in the consumer-TV space simply does not justify the return on investment. In the meantime, consumers at least will continue to benefit from the increased market competition. •

1

The G20 includes Argentina, Australia, Brazil, Canada, China, France, Germany, India, Indonesia, Italy, Japan, Republic of Korea, Mexico, Russia, Saudi Arabia, South Africa, Turkey, the United Kingdom, the United States, and the European Union.

Steve Sechrist is a display-industry analyst and contributing editor to Information Display magazine. He can be reached at sechrist@ucla.edu or by cell at 503-704-2578.