Raising Capital for Technology Ventures

Raising Capital for Technology Ventures

Investors come in different packages. It’s important to know the various types, along with their pluses and minuses. This article is the second of four in a series by a venture capital expert who has both launched and funded new companies.

by Helge Seetzen

IN the first article of this series, we talked about the fundamental building

blocks of a new technology venture: inventions and teams. It is a fact that this talent generally wants to be paid. Almost all technology ventures need significant capital to grow their operations.1 Unless the founders can contribute significant personal cash, something I would not recommend even if possible, that money needs to come from external investors. In this article, we will talk about the different sources of investment, their requirements, and typical valuations and terms.

Capital Needs

The first step is to identify the capital needs of your venture. Few technology businesses achieve profitability after a single round of

financing, so it is worth planning multiple investment rounds. The time horizon between rounds thus becomes the determinant of the capital

needs of the business. Each round will ideally be raised at a higher valuation than the last one – failure to do so will make your earlier investors very unhappy, with often painful consequences for your ownership of the business. Thus, the goal is to raise enough money to achieve a material increase in

valuation and then have sufficient time left to raise the new round.

For convenience, investment rounds are often given names such as Seed Round,

Series A, Series B, Series C, etc. The labels have no firm meaning and are sequential (e.g., Series B is the second round raised after a Series A). That said, common understanding in the industry defines typical rounds as follows:

Seed Round (usually below $500K): The initial team is in place with a business plan, but things are usually still

a bit rough around the edges. The capital will likely be used to complete the core of the business and build

the first product prototypes. Revenue is generally not expected.

Series A ($1 million - $3 million): Usually this is the first major and/or institutional round. The business is fully operational with possible initial revenue. Certainly, some form of market validation should be in place, as well as all the

core team roles filled with high-quality people.

Series B ($3 million +): At this stage, the engine of the business is humming and the new capital just

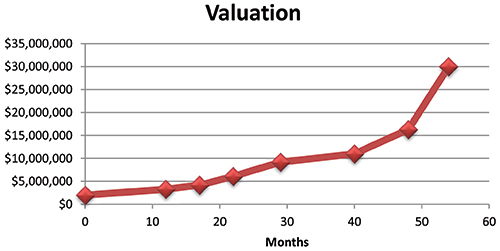

adds more fuel. The focus will be on scaling and growth management. Of course, there are plenty of companies that raise a Series B, i.e., their second institutional round, while still looking like the Series A company described above, but that’s generally a sign of something having gone wrong or both rounds being smaller than usual2 (see Fig. 1).

Fig. 1: The valuation history of BrightSide Technologies (one of the author’s ventures) is shown over a period of 5 years.

Most early-stage companies will consider either a Seed Round or maybe an early

Series A if they are able to bootstrap through the Seed stage without raising

significant external capital (possibly with the help of the three “Fs” – Friends, Family, and Fools.

When determining capital requirements, consider how much money the business

needs to go from one stage to the next. So, if you are raising a Seed Round, consider how long it will take to achieve

product revenue and full team build-out (the general criteria for Series A). Then, add at least 30% as a buffer since nothing ever works as planned in a

startup. Finally, add 6 months of additional operating time to account for the fact that

fundraising itself takes time. The total amount needed over this period defines the capital requirement for

your new round. With that number in hand, you can consider the different funding sources

available to early stage technology ventures.

Sources of Funding

We currently live in a fortunate time for entrepreneurs – investment capital is readily available. However, times do change, apparently fairly cyclically, so enjoy these years while they last.3 But money comes from many different sources. In practice, however, the wide variety of investor types can be grouped into three principal sources of funding:

Accelerators: These entities tend to provide much of their value in kind, through mentorship, support, and services, but often also invest relatively small amounts of money into the business (usually tens of thousands of dollars but rarely more). With a few exceptions, accelerators are designed for ventures that require assistance to get off the ground with the money being usually a secondary benefit – so evaluate them based on the value of the offered support in relation to your venture’s weaknesses.

Angel Investors: Angel investors are high net-worth individuals willing to invest in early-stage

companies. Many of them are former entrepreneurs who are keen on experiencing the start-up

rollercoaster but, ideally, without putting their nose all the way to the

grindstone again. They tend to invest relatively modest amounts, with $25K–250K being a common range per investor. Fortunately, angels tend to work in groups, often in formally organized networks, so it is usually possible to raise

combined rounds of angel capital up to about $1.5 million.

Venture Capital: Professional investors, called Venture Capitalists (VCs), manage significant funds on behalf of their limited partner (e.g., pension funds, government funding, large corporations, etc.). Such funds come in different sizes and shapes, but commonly invest upward of $500K during initial rounds. Unlike angels, venture capitalists also have the ability to follow their initial investment with major secondary and tertiary investment rounds, reaching often into the tens of millions of dollars.

These are the three most common types of investors for early-stage technology

ventures.4 Of course, the world is full of variance, including the more recently emerged concept of super angels – effectively venture capitalists who manage smaller funds and behave more like angel investors. Nevertheless, it is easiest to think of investors in these three broad categories: those that assist, those that invest their own money, and those that invest other people’s money. These distinctions make a major difference in terms of the amount of available capital and the goals of the investors.

Angel investors are generally more comfortable with modest returns but usually

also want to see some cash coming back to them in a shorter time frame than

VCs. A common rule of thumb is that a 2–3× return in 3–4 years will make most angels happy. Venture capital funds can deploy much more capital over longer fund cycles of 10–12 years, but also have much more aggressive 5–10× return goals due to their non-linear compensation structure (more on this next

month). Individual investment goals of course vary greatly, so I would strongly

recommend an open discussion before you seal your new relationship. In general, it is a good idea to build a positive relationship with future

investors long before you need their money – date first, then marry.

Often the match-up between capital needs and sources of funding is fairly

obvious at this point. Service business or other opportunities with limited capital requirements are

often better served by angel investors. On the other hand, if your business plan requires $10 million+ to build a viable product or advanced demo, then venture capital is likely the only way to go.

Maybe you can find an accelerator with good access to deep-pocket VC funds or

some well-connected angels, but your road will eventually lead you through the

doors of a VC. Once on this road, make sure to optimize your business strategy around the goals

and timelines of venture capital. Display hardware projects are commonly on this trajectory, with all the positive and negative

implications.

Of course, reality is rarely this conveniently defined, so all kinds of mixed

deals are possible. Some ventures are able to combine angels and seed VC investors; some use a

strong group of angel investors to drum up support for a high-valuation VC

round, and so forth. But such schemes are usually best left to seasoned entrepreneurs – managing different interests is a difficult game with generous amounts of pain waiting on the sidelines if you get off track.

Valuation and Terms

Once you have defined your investment sources and have built a good relationship

with them, there comes the magic moment when you receive a term sheet. As the name implies, this is a short document listing the principal terms of the

investment deal. That document will have two important numbers: the size of the investment and

the valuation of your company. Let’s ignore the more complex terms for now and focus on the most basic scenario to

explain the terminology: if you are raising $1 million and your company is deemed to be worth $3 million,

then your “pre-money valuation” is said to be $3 million and your “post-money valuation” will be $4 million. Post-money, you will of course only own 75% of your company ($3 million out of $4 million) so you will have experienced a 25% “dilution.”

Post-money valuation is just pre-money plus cash raised, but how is the pre-money valuation determined? At this point the technical reader will likely expect a complex formula but reality is much less fancy (at least until you reach the earnings-based valuation models of late-stage ventures). Counterintuitively, your early-stage valuation is less about the value elements of your business and more about the type of investor you can attract. Most investors will take 20–40% of your company for each round of financing regardless of the amount invested. Thus, a VC Series A round of $2 million tends to have pre-money valuations of $3 million – $5 million, while an angel seed round of $500K will have pre-money valuations of about $1 million – $2 million. There are, of course, plenty of exceptions, but as a rule of thumb this tends to hold fairly well for early stage rounds.

So, why use an approach that is so unscientific? It’s about time and mind-share. The stake for investors needs to be small enough to leave incentive for the management team and large enough to make their mind-share investment worthwhile. For example, most VC funds are expected to have one of their partners sit on the Board of Directors of each of their investments. Since a partner can only reasonably sit on about five boards, they need to make large enough investments to make each deal worth their time. Thus, what changes during early stage rounds is the amount of money you get for a given funding round of 20–40% dilution – hot companies getting more while weaker ones get less.

The goal then is to rapidly advance your venture to the point where it can raise money from investors with deeper pockets, watching your effectively pre-money

valuation rise as a side effect.5 Do not spend on infrastructure, support hires, or anything else that does not contribute to the advance to the next investor class. Of course, the value elements of your venture – team, product, revenue – are the means by which you advance to a new investor class. So, ultimately it is all still about building team and traction.

So far, in this series, we have covered building a great founding team and, with

this article, the basics of capitalizing that team. In the next piece, we will dig a bit deeper into the structure of a venture

capital (or angel) financing scenario, including common deal terms, pitfalls,

and some tips for valuation optimization. •

1Exceptions are usually limited to service businesses that can generate immediate revenue. This is rare for genuine technology ventures where the product, the technology, still requires significant development before it can be commercialized. In this context, it is also important to remember that venture implies growth. Businesses that essentially outsource the work of the principals as consulting or contract work might be able to self-finance from the start, but are best described as self-employment and not ventures. Venture capital investors will certainly not be interested in such opportunities, even if they provide very nice lifestyle returns for the principals.

2BrightSide Technologies, Inc., my second venture, was an example of the latter. For business reasons, we raised the first five rounds of angel financing below $1 million each. At that point, we were technically raising a Series F, but in practical terms we had raised less than $4 million total and were thus functionally similar to a Series A company. Valuation rose with each of our rounds, and the final outcome was a success for all investors, so the above guidelines are not definitive by any means.

3Those who feel that fundraising today is too difficult should talk to veterans of earlier times. For example, Sunnybrook Technologies. Inc., my first venture, started fundraising in 2001 – hardly a time when IT technology start-ups were popular, given the recent demise of nearly the entire sector in the dot-com bubble.

4Non-investment sources of funding of course also exist: grants, loans, subsidies, etc. Most of those are often inaccessible for early-stage ventures, though I would encourage all entrepreneurs to at least canvass the available economic development grants in their jurisdiction – free money is always a blessing for any new venture.

5One of the most common business failures comes from a lack of understanding of advancement criteria. A growing company might be capped to an ~$4 million valuation range simply because its local angel group cannot find more than $1 million in capital and cannot close the deal if its members get less than 20% of the company per round. If the CEO cannot advance to the next investor group, the company is likely doomed no matter its business success.

Helge Seetzen is CEO of TandemLaunch Technologies, a Quebec-based company that commercializes early-stage technologies from universities for its partners at major consumer electronic brands. He also co-founded Sunnybrook Technologies and later BrightSide Technologies to commercialize display technologies developed at the University of British Columbia. He has published over 20 articles and holds 30 patents with an additional 30 pending U.S. applications. He has a Ph.D. in interdisciplinary imaging technology (physics and computer science) from the University of British Columbia.