Display Week 2013 Review: LCDs

Display Week 2013 Review: LCDs

LCDs dominate the display market despite challenges.

by Alfred Poor

HERE’S A MYSTERY: liquid-crystal displays (LCDs) dominate just about every information-display application worldwide these days. Yet, to paraphrase Winston Churchill’s famous quote about democracy, LCDs are the worst form of display technology except for all the others that have been tried.

Consider the following: It is a fussy technology that requires a complex

switching backplane. It is not a solid-state solution; it actually requires that some components

physically change their location and orientation in order to work. And it is dreadfully inefficient in that a typical active-matrix LCD consumes

95% or more of the transmitted light, even when it’s showing a pure-white image. As a result, you have to use very bright backlights, which, in turn, require

complex light recovery and management components to make efficient use of this energy.

Yet, despite of all this, LCD technology remains without question the dominant

electronic-display technology in the world. Nowhere was this more evident than at SID’s Display Week 2013 in Vancouver, British Columbia, Canada, last May. From the Exhibit Hall to the Symposium, it was clear at every turn that LCD

technology have an enormous lead over all other display technologies, and this

situation is not likely to change soon. It is true that cathode-ray tubes (CRTs) once held a similar lead that seemed

insurmountable, but current competing technologies are not gaining much

traction, while LCDs continue to improve. Organic light-emitting-diode (OLED) displays are starting to build out from

their beachhead in the mobile-device market, but they remain a small factor in

the overall numbers. Reflective and bistable displays continue to evolve and have had some success in

niche segments, but show little sign of competing in any significant way in

broader markets. The fact remains that LCD technology continues to improve – and costs continue to fall – faster than the levels achieved by competing technologies. This makes it difficult for any alternative to mount a serious challenge.

LCD industry revenues are forecast to grow even as the unit prices of the

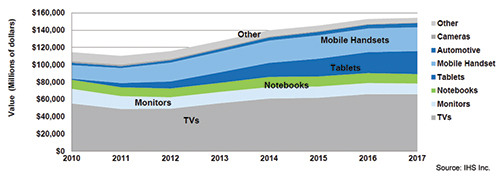

products continue their steady decline. As was pointed out by Sweta Dash from IHS at the Display Week Business

Conference, LCDs will generate more than $120 billion in market value this

year, a figure that will climb to more than $150 billion by 2017 (Fig. 1).

Fig. 1: According to IHS, LCD worldwide revenues are forecast to continue to rise in the near future, despite stagnating television sales and declining unit prices in general. (Source: IHS)

More Pixels

While there were many interesting improvements in LCD technology in evidence at

Display Week 2013, one clearly stands out from the rest. The trend toward “4K” resolution displays is gaining momentum, which was evident just about

everywhere you turned at Display Week.

For example, Mike Lucas, Senior VP of Sony’s Home Entertainment and Sound Group, addressed the Business Conference with a

presentation on “4K: The Resolution Revolution.” Citing nearly 75% penetration of HDTVs in the U.S. and a move to larger set

sizes, he made the case for increasing resolution on TVs to 4K resolution (four

times the pixels of HDTV). More than 15,000 digital cinemas already have projectors with 4K resolution,

more than 100 feature films have been released in 4K, services including

Netflix are developing prototype streaming services for 4K content, and Sony

has a 4K media player that can download new content from the Internet. Clearly, many manufacturers are hoping that 4K will revive flagging interest in

new televisions and help shorten the replacement cycle for consumers.

A 4K LCD was the recipient of one of the SID Display Industry Awards this year. The 110-in. LCD TV from Shenzen China Star Optoelectronics Technology (CSOT) won

the Silver Award in the Display of the Year category. This model also supports 3-D TV using active-shutter glasses, incorporates

multi-touch technology, and has a dynamic backlight to boost contrast performance.

Other 4K LCDs were on display in the Exhibit Hall. Samsung showed its giant 85-in. prototype (Fig. 2) and LG showed its nearly as enormous 84-in. screen (Fig. 3).

Fig. 2: Samsung was one of the major display makers showing products that raised the bar for LCDs, including this 85-in. 4K panel. (Photo credit: Alfred Poor)

Fig. 3: LG also is helping to bring the “big screen” to living rooms worldwide with its 84-in. 4K LCD panel. (Photo credit: Alfred Poor)

New technologies are also bringing these high-resolution images to smaller

screens. For example, the metal-oxide IGZO backplanes have higher electron mobility than

the standard amorphous-silicon (a-Si) backplanes, which makes it possible to

create smaller transistors for the active-matrix backplanes. Sharp was showing a 31.5-in. LCD panel that offers 4K resolution using an IGZO

backplane (Fig. 4).

Fig. 4: Sharp’s 31.5-in. LCD panel relies on an IGZO metal-oxide backplane to deliver 4K

resolution. (Photo credit: Alfred Poor)

Smaller Pixels

In fact, the fabrication of smaller and smaller pixels is another area where LCD technology has been advancing. With the ever-growing consumer interest in smartphones and tablets, manufacturers are seeking to increase resolution as a differentiating feature. Smaller pixels mean that a panel has more pixels per inch. In order to create an active-matrix display, each pixel must have at least one transistor switch. These switches have to be small enough to let some light through (the aperture ratio), so the development of backplanes that support smaller semiconductor devices is a primary driver for higher resolutions. There were many examples of displays with small pixel structures throughout the exhibit hall. For example, Samsung showed a new 13.3-in. LCD panel with an amazing 3200 × 1800-pixel resolution, which works out to 276 pixels per inch (ppi).

That pales by comparison to the one that Innolux was demonstrating. Its full HD (1920 × 1080-pixel resolution) panel was only 5 in. on the diagonal. Using low-temperature polysilicon (LTPS) TFTs for the backplane, the panel was able to display 444 ppi. This is all the more impressive because each pixel was composed of four subpixels – red, green, blue, and white – and the display also had a panel border of just 0.5 mm.

Smarter Pixels

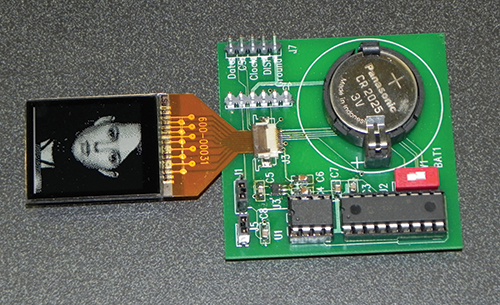

LCD pixels are not just getting smaller, they are getting smarter, too. Sharp showed its Memory LCD panels that have one bit of memory embedded in each

pixel of the monochrome (black and white) displays (Fig. 5). This makes it possible to greatly reduce the power consumption required to maintain an image compared with conventional LCD designs. Some models are designed to run on 3-V dc power supplies, making them compatible with standard “button” batteries.

Fig. 5: This tiny LCD panel from Sharp includes memory for each pixel, which greatly

lowers power consumption. (Photo credit: Alfred Poor)

Pixels are getting smarter in other ways as well. Working in partnership with Nanosys, 3M announced its new Quantum Dot Enhancement Film (QDEF). The quantum dots can convert light of one wavelength to another, and they can be tuned to produce a very narrow range of wavelengths, which results in precise colors. In turn, this greatly increases the color gamut that LCD panels can display. The film takes the place of another film already used in LCD backlights, which means that no production changes are required to use this material with existing panels. (3M won a Display Week 2013 Best-in-Show award for this product.) Quantum dots are also used by the Color IQ material made by QD Vision. This is used in select models of Sony’s BRAVIA LCD-TV product line and helps increase the color gamut of the display. Color IQ received the Gold Award for the SID Component of the Year, which was presented at Display Week 2013.

Many Kinds of Pixels

These examples just scratch the surface of the LCD products shown at Display

Week 2013. Some had unusual shapes or configurations. For example, Kyocera showed a 2.5-in. round LCD with a 240 × 240-pixel resolution. Japan Display Inc. (JDI) had a rectangular LCD panel designed for use in an

automotive instrument cluster. This panel had a hole in the middle that would accept the shaft of a

conventional mechanical indicator. The result is that automobile engineers can design gauges that can provide

different displays using a physical pointer. JDI also had a mockup of a car’s dashboard using curved and circular LCDs (Fig. 6).

Other automotive panels were also in evidence, such as Kyocera’s rearview-mirror display, which is already in production.

Fig. 6: This curved automotive dashboard from JDI demonstrates the many ways that LCDs

can be adapted to bring new functionality to existing applications. (Photo credit: Alfred Poor)

An area of specialization to note is high-brightness displays, which include

sunlight-readable modules for use everywhere, from avionics to bank ATMs. LG had a panel intended for digital-signage applications that boasted a

luminance of 2000 nits (candelas/ square meter). MacroDisplay, Inc., demonstrated a novel approach to sunlight-readable displays

by using its directional light-guiding film (DLGF). This allows an LCD panel to employ both a backlight and a bright ambient light

as an illumination source, so that the same panel can be used in daylight and

indoor settings. BrightView Technologies offers a variety of high-brightness solutions and was

showing a choice of cold-cathode fluorescent (CCFL) and light-emitting-diode

(LED) backlights. The company also provides dimmable panels, so the same display that is suitable

for high levels of ambient light can also be dimmed for nighttime viewing. Mitsubishi Electric Corp. and Santek were among other LCD-panel providers

offering high-brightness products.

In addition to all these, there was a nearly endless assortment of panels for industrial applications and other uses. One interesting development is that nearly all the LCD panels offered now use LED backlights instead of CCFLs. Many of the manufacturers and vendors provide support for their clients who want

to switch from CCFLs to LEDs for the panels used in their products. Endicott Research Group (ERG) specializes in this area and was showing a number of power-conversion products and drivers for LCD backlights at Display Week. Renesas Electronics America showed a wide variety of panels from NLT

Technologies, primarily focused on value-added solutions for lower-volume applications. This company is affiliated with Tianma Microelectronics, which showed a range of high-volume solutions. These included panels with integrated projected-capacitive (p-cap) touch, displays for outdoor viewing that use transmissive or reflective technology, and panels for specific purposes such as medical applications.

Moving Forward

If the Symposium is any measure of overall interest in improving LCD technology,

the field continues to advance. Only the subject of 3-D displays had more sessions devoted to it than liquid

crystals and related topics. If you added the sessions on TFT and metal-oxide semiconductor research, LCD

topics outnumbered them all. Perhaps the most intriguing session of all was Session 5, which presented three

different views of the competition between LCD and OLED technology for

displays, especially in the mobile-device market. The strong indication is that OLED technology is not likely to mount a serious

challenge to LCD dominance, at least for the short term. Industry-analyst David Barnes of BizWitz gave a compelling analysis that

predicts that no matter which technology wins out, it is the consumer who will

likely gain all the benefit of the competition. Yasuhiro Ukai from the Ukai Display Device Institute took the position that LCD

dominance is likely to continue, although there is room for improvement in

manufacturing efficiency. And Joun Ho Lee and colleagues from LG Display presented a comparison of LCD and

OLED performance in mobile displays, showing that LCDs have some specific

advantages for resolution, contrast ratio, and color.

The LCD industry is an industry with an apparently insurmountable lead in many market segments. Part of the reason for this status, despite the technology’s aforementioned shortcomings, is that the researchers and the companies behind LCDs are not complacent. Competing technologies keep stepping up to challenge LCDs in one segment or another and before they can do so, LCD technology raises the bar. Think of OLED technology’s edge in terms of color, contrast, and panel thickness and how every year, LCDs improve so as to lessen that edge on all three counts. Display Week 2013 clearly demonstrated that liquid-crystal technology continues to provide the best value for many applications by combining excellent performance with low cost, and that everyone involved in the industry continues

to invest time and money to make these displays more versatile and powerful than ever. •

Alfred Poor is a Senior Member of SID and Contributing Editor with Information Display

magazine. A speaker and writer with an international reputation, he has followed the display industry for decades, yet still gets excited by the improvements in display technology. He can be contacted by e-mail at apoor@verizon.net.