New Directions for Digital Signage and Public Displays

New Directions for Digital Signage and Public Displays

Part one of our two-part series on the market dynamics of digital-signage applications for commercial (or public) displays looks at the growth of the

industry and the technologies that are helping shape that growth into the future.

by Todd Fender

NOW that unit shipments of public displaysa have rebounded from 2012 lows caused by the global recession of 2008–2010 and are showing signs of longer-term sustainability, companies in the digital-signage eco-system are searching for ways to best position themselves to take advantage of this growth. However, as might be expected, the display landscape has changed in the meantime. New display technologies, resolutions, product features, and form factors are now available. In order to determine their future direction, many display companies are asking

themselves which of the above will be the driving forces behind this growth and which vertical markets or applications hold the most promise.

Market Dynamics

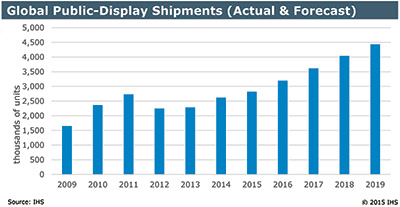

After an 18% decline in 2012 and a relatively flat 2013, the global large-screen public-display market rebounded in 2014 by 14.6%. It was up 10% in the first half of 2015 and is forecast to grow through 2019 (Fig. 1).

Fig. 1: Global public-display shipments (actual and forecast) show sustained growth from 2013 through at least 2019.

In 2009, global shipments of public displays 26 in. and larger totaled 1.6 million units. Shipments are forecast to approach 3 million units in 2015 and near 4.5 million units in 2019, according to the most recent Quarterly Public Display Tracker Report from IHS. In Q2 ’15, shipments were just over 650,000 units; an increase of 1% Y/Y and –5% Q/Q.

Revenues have grown in a similar fashion. In 2009, global revenues were $1.7 billion. In 2015, revenues will more than double that of 2009 to reach $3.6 billion. In 2019, those revenues are forecast to more than double and exceed $8 billion.

The 60–99-in. size category is forecast to increase at a 33% CAGR from 2014 through 2019, as the 85-in. variety in particular will grow at a 135% CAGR in the same time period. However, 70-in. public displays will show the largest unit volume increase – more than 325,000 units.

Although displays with ultra-high-definition (UHD) resolution will lead on a percentage growth basis, increasing at almost 80% CAGR through 2019, unit growth is only expected to be 330,000 units. Shipments of displays with full-high-definition (FHD) resolution are expected to increase by over 2 million units in the same time period.

Digital-Signage Market Technologies

Now that commercial plasma displays are no longer being manufactured, liquid crystals are the dominant technology used for public displays. This direct-view flat-panel technology has become relatively affordable and readily available, due to the significant price erosion that has occurred over the last several years and to rapid adoption by the consumer television market. (Although there are slight differences in the build of a television LCD panel vs. a public-display LCD panel, there tends to be a direct relationship between the sizes and resolutions that sell well in the consumer market and those that are eventually developed into public-display panels.) In addition to LCDs, a number of “up-and-coming” technologies are possibilities for the future direction of digital signage. These include OLEDs, which will be discussed in part 2 of this series later this year. The most prominent such technology, however, is direct-view LED technology.

Direct-View LED Technology

Historically, direct-view LED technology was limited to the outdoor realm (sports stadiums, sides of buildings in major cities, billboards, etc.), due in part to wide pixel pitches (low resolution) and high cost. Mitsubishi, with its Diamond Vision LED display systems, and Daktronics have been industry stalwarts for many years.

The modular design of direct-view LED displays makes it easy to scale to very large sizes and allows for non-typical shapes and sizes. According to the latest IHS Signage and Professional Displays Market Tracker, 83% of all direct-view LEDs shipped globally in Q1 ’15 had pixel pitches of 10 mm or greater. This percentage was down from 90% 2 years ago. (For more about professional displays, see part 2 of this article.)

In 2013, shipments exceeded 180,000 units globally (one square meter of viewable area equals one unit). In 2015, shipments are forecast to approach 240,000 units and will near 400,000 units in 2019. Revenues will grow from $1.22 billion in 2013 to $1.96 billion in 2019.

However, in just the last 2–3 years, the industry has seen an explosion of small-pixel-pitch direct-view LED samples shown at the major industry exhibitions, most of which have been introduced by Asian-based companies (mainly China and Taiwan).

At InfoComm in June 2015, major brands Christie, Daktronics, Leyard, NanoLumens, and Panasonic all showed narrow-pixel-pitch LED video displays ranging from 1.2

to 2.6 mm pixel pitches. SiliconCore Technology, an innovator and manufacturer of LED displays and laser-diode controls, showed an array of ultra-narrow-pixel-pitch direct-view LED displays, including 1.2-, 1.5-, and 2.6-mm offerings.

Planar Systems, known more for its mosaic architecture LCD-based commercial displays, showed similar direct-view LED modules at InfoComm, and in August

2015 was acquired by Leyard. Prior to this acquisition, in March 2015, Samsung acquired YESCO to gain access to its wider-pixel-pitched products to augment its newly released indoor smaller-pixel-pitched direct-view LED modules.

Today, these narrow-pixel-pitched products are very expensive compared to direct-view LCD products. Therefore, they are competing more directly with laser-projection technologies and in niche, unique, or customized applications and installations.

Larger Screen Sizes, Smaller Bezels

A key trend in digital signage is increasing size. Each year, larger direct-view LCDs are announced, shipped, and sold. In 2013, Sharp briefly shipped a 108-in. FHD public display. In 2014, 98-in. UHD models began shipping from several companies (LG Electronics, NEC Display Solutions, Planar, and Panasonic). In 2015, Samsung began shipping its 105-in. 5K-resolution display.

However, as the size of the display approaches and passes the 100-in. mark, the viability of shipping it effectively, efficiently, and with minimal damage is questionable.

As an alternative to a single large display, with the continued improvements in super-narrow-bezel (SNB) technology, it is becoming easier and more acceptable to tile smaller-sized displays together to form larger video walls.

Not too long ago, a public display or any display for that matter that had a single-side bezel measurement of 10 mm (equivalent to a 20-mm bezel-to-bezel

(BtoB) measurement) or less was considered by some as a “narrow” bezel display. In the last 3 years, LG Electronics has shown LCDs at the annual InfoComm Exhibition measuring 4.9 mm (BtoB) (2013), 3.5 mm BtoB (2014), and less than 2 mm BtoB (2015). A bezel-to-bezel measurement is the sum of two bezel measurements (one bezel from one display and another bezel from an adjoining display).

Although the viewer can still see lines between the individual displays (a.k.a. window-pane effect), at smaller than 2 mm it becomes less of a distraction. It is expected that bezel-size reductions will continue to be made, and the bezel gap will narrow either mechanically or optically. Manufacturers and integrators are therefore finding it easier to manipulate multiple 40-, 50-, and even 60-in. displays to create large video walls. Mount manufacturers have also made it easier to tile the displays in a uniform configuration and many now allow easy removal of a single screen for service.

Luminance and color uniformity for the tiled displays is still a challenge for some makers, and definitely for televisions (more on this later); however, most major brands include solutions (hardware and software) to combat these issues.

High-Bright and Half-Height

Panel manufacturers are always looking for new ways to recoup the billions of dollars they have invested in manufacturing facilities. In order to do this, revenues alone are not enough. They need to focus some of their resources on products that have higher profit margins or, more precisely, products that generate more margin dollars.

For the last several years, the profit generators have been narrow- and super-narrow bezel panels. In addition, some panel manufacturers are beginning to focus more attention on the development of high-brightness panels (700+ nits) than in the past. These panels are used in developing outdoor or semi-outdoor displays, such as for quick-service restaurants (QSRs) drive-thrus, street-side kiosks, outdoor retail, or public walkway areas at sports stadiums, etc.

There are currently high-bright solutions in the marketplace. However, the price points are at significant premiums. As more high-bright panels are manufactured, yields will improve and economies of scale will be realized, which generally equate to lower prices.

LG Display is working on a high-bright panel it refers to as M+ technology, which allows the company to produce high-bright panels with lower power consumption than typical high-bright LCD panels; however, the acquisition price is much higher than for those typical high-luminance panels. We expect the price to come down as more panels are produced.

Another product area a few panel makers have circled back to are half-height, stretched, bar-type, or transportation panels. Whatever name they go by, they are the same thing; very-wide-aspect-ratio displays, designed mainly to replace bus and train signage. A few years back, displays utilizing these types of panels were introduced to less than ecstatic response. According to the IHS Public Display Market Tracker, approximately 2,000 units of these half-height displays were shipped globally since 2012.

It is possible these panels were launched before their time and will have better sales success now. AU Optronics has introduced 28- and 38-in. models, which have been picked up by BenQ and made into displays. Samsung has launched a 24-in. panel, and recently even larger sizes, such as 16:3 and 16:4.7 have been planned by a major panel manufacturer.

Televisions and Public-Display TVsb

As IHS has mentioned in the past, the biggest threat to the public-display market remains televisions. Although much can and has already been said about the ideal performance and potential lower total cost of ownership of public displays, the industry is realizing that not everyone needs a commercial display. There are tradeoffs, and price is usually king.

IHS tracks shipment of public displays and public-display TVs in the IHS Public Display Market Tracker. Public-display TVs are more of a hybrid category, which is usually identified by a lower warranty (2 years instead of the standard 3 years), features like RS-232C (for remote control and monitoring), and button and I/R lockout. Sometimes they include a tuner and digital-signage content software. These displays are intended for usage up to 16 hours a day. Several major brands are targeting the small-to-medium business (SMB) market with these types of displays and have shown some recent success. Examples of this market include “mom and pop” stores, non-franchised fast food shops, laundromats, boutiques, etc.

However, there are some end users that are using consumer televisions for their public displays. What they give up in performance, longevity, and warranty, they gain in price. The quality of consumer televisions has increased significantly over the past several years and the quality gap between a consumer television and commercial displays has narrowed considerably.

When the price of a large television falls below the $1000 and even $500 mark, more customers have been willing to take the risk. In some scenarios they are pleasantly surprised that the television did the job they needed. In others, the television usually performs well for a year or two. When it fails, the loss is not catastrophic. The low acquisition price puts it in a “throw-away” category and the customer ends up buying a larger

screen, with better technology for a lower price.

This is not to say that the market for true public displays is not healthy or growing. There are still many solutions that need 24/7 performance and all of the

advanced features of a commercial public display. However, the low end is clearly limited in terms of growth potential.

UHD and HDR

The overall display industry has continued to move to higher-resolution displays based on the perceived need by the end user to be able to see images better and

in more detail. On the consumer side, the latest transition (to UHD) has performed fairly well, since price premiums have been reduced significantly, especially by third-tier brands. By the end of 2015, 15% of television shipments will be generated by televisions with UHD resolution. By 2019, this percentage will climb to 40%, according to the latest IHS TV Sets (Emerging Technologies) Market Tracker Report. However, for public displays, this transition has not occurred as rapidly and is not forecast to ramp up aggressively.

First, the price premium for a UHD display vs. an FHD is greater for public displays than for consumer televisions due to production and manufacturing variables in addition to the limited volumes. This premium may be reduced in the future as some brands introduce common public-display sizes that will compete head-to-head with their FHD counterparts.

Second, most public-display solutions are intended to reach audiences that have far greater viewing distances than those of at-home consumers. As the viewing distance increases, the perceived image quality or difference between FHD and UHD lessens. There are many different screen size vs. viewing-distance calculators on the Internet that provide a good indication of where perceived image-quality difference does and does not exist. At a recent USFPD IHS Conference in Santa Clara, California, it was stated that the minimum size of a display in order for viewers to see the difference between FHD and 4K is 50 in.

There is also some speculation that to deliver networked high-resolution content to these displays will require many customers to upgrade their infrastructures.

This may be very costly for some or may just be another roadblock that has them questioning if it is needed or just wanted. Customers will definitely be considering ROI in this context.

With all of this, add to the mix that 8K is already being talked about and it seems some want it available sooner than later. The Japanese 2020 Olympic committee is already stating that the games will be televised in 8K.

It is for these reasons that IHS analysts believe shipments and sales will be initially limited to niche vertical markets such as high-end retail where the audience will be within 2 m of a 50-in. or larger display and where the company believes that higher resolution plays into its brand messaging of quality.

High dynamic range (HDR) is the second of the one-two-three punch the television industry is counting on to spark a new replacement cycle. (The first punch was UHD resolution.) HDR refers to a combination of higher luminance capability for whites and more selectable levels of gray scale (higher bit range) for the R-G-B channels. This wider range produces more realistic images and is said to be able to produce images the eye actually sees vs. what the camera sees.

HDR is not new; in fact, the photography industry has been using it for years. In laymen’s terms, three pictures are merged together to produce one “realistic” photo. However, in the display industry, HDR is relatively new. One of the main reasons is in order to take full advantage of the improved image results, HDR content is required.

Among others, Dolby has been working diligently in the HDR space and has developed a relationship with several television brands, including Vizio, for Dolby Vision licensing processing software. However, it works best on high-bright displays (800 nits+), which are typically uncommon in the television marketplace today.

HDR alone is not enough to complete the replacement cycle; however, paired with wide-color-gamut display capabilities, whether created through the use of phosphor-coated LEDs or quantum dots or other solutions, offering more colors in the color palette makes the user experience that much more dynamic.

It will take some time for these technologies to trickle down to the benefit of the digital-signage marketplace, but when they do, it will help digital-signage networks charge a premium or give them the ability to secure the upper echelon of advertisers who demand more control over the imagery.

Opportunities and Threats

The public-display market is poised to grow over the next several years as economic and market conditions have stabilized or improved and as emerging countries begin to invest. The majority of the growth will be derived from an increase in sales of larger-sized displays (50 in. +). One of the biggest threats to the growth of public-display shipments will be the continued acceptance and shift by end users of using consumer televisions or public-display TVs for 16/7 (or less) operation.

LCD technology will continue to be the dominant volume and revenue technology for the next few years in standard aspect ratios. For larger panels, LEDs provide nearly any size and nearly any resolution. In parallel, “newer” technologies will begin to enter the space, first as niche solutions and then,

as prices decrease, in greater volumes. On a percentage basis, LCDs with UHD resolution will grow the most; however, this growth stems from relatively small unit shipments. Shipments of FHD displays will grow by 1.5 million units between 2015 and 2019. Talk of HDR and wide-color-gamut displays will begin to enter conversations; however, the price premiums will force these displays to remain niche for the time being.

The top five digital-signage brands in terms of signage as of Q2 ’15 (LG Electronics, NEC Display Solutions of America, Philips, Samsung, and Sharp) have positioned themselves well to continue to dominate the marketplace, although their individual rankings may change over time. There still appears to be room for smaller manufacturers and integrators to grow their businesses by focusing on niche vertical markets by utilizing products such as high-bright outdoor displays, half-height transportation displays, and other specialty displays.

The quest for larger public images will continue to fuel the video-wall market along with the increase in ultra-narrow-bezel panel and display production. Small-pixel-pitch direct-view LED displays will start to compete for more volume as the average selling prices erode. Until then, their usage will be niche or custom.

Footnotes

aThe term Public Displays is a general term used to describe displays that have been designed for commercial usage (or commercial displays). These displays contain components that allow them to perform 24/7 for a minimum of 3 years. They are most commonly used for digital signage, which actually describes digital advertising. There are some “hybrid” displays or “public-display TVs” that are marketed as public displays but are only designed for 16/7 (16 hours a day, seven days a week) operation (2–3 year warranties). Lastly, some digital-signage customers purchase consumer TVs built to perform 4–8 hours a day that carry a 1-year warranty.

bHere, televisions refer to consumer televisions (the same ones people buy at local retailers and use at home). They are not designed for 24/7 operation and have 90-day to 1-year warranties at most. Many also come with disclaimers that say the warranty is voided if used outside the home. •

Todd Fender is a principal analyst within the IHS Technology group. He can be reached at todd.fender@ihs.com. For more detailed information and analysis on the public display, professional display, and specialty display markets, contact todd.fender@ihs.com or visit www.technology.ihs.com.